Executive summary

- MSCI China’s equity valuations have come off due to a variety of well flagged issues.

- Current valuations are at historical lows.

- The changing composition of the index to more “new economy” names suggest the nearer-term historical average valuation may be a more appropriate gauge of the market’s inherent value.

- China internet may be a “new economy” sector, but the high growth era is probably behind due to increased regulation since 2021. New business drivers however could contribute more meaningfully.

- There could be re-rating potential ahead if EPS growth rebounds and if there is relaxation to the zero-Covid policy.

Background

The MSCI China index has slipped considerably since end Q1 2021 to date (end Q3 2022) due to a variety of well flagged issues – heighted regulatory scrutiny in selected areas, Covid lockdowns, property market weakness, and a softer external environment have weighed heavily on China equities.

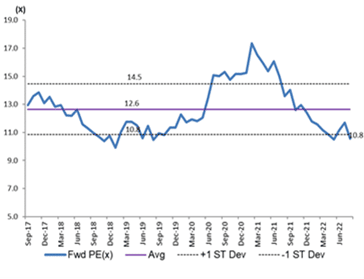

Consequently, valuations have come off significantly with current valuations now close to historical lows, exceeding the lower one standard deviation bound of its 5-year historical PE average (see Figure 1).

Figure 1: MSCI China’s 5-year historical forward PE

Source: Datastream, September 2022.

Are Chinese equity valuations attractive now and could they be poised for a rebound? Or will they remain trapped at these dampened levels?

Evolution of the MSCI China index

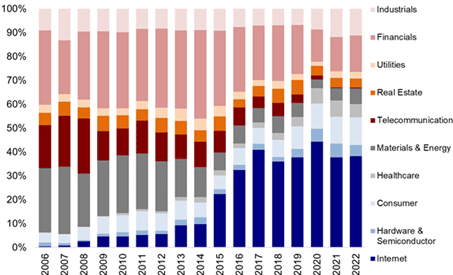

We look to address the above question by first examining the constituents of the MSCI China index, which has evolved considerably over the years. Historically, sectors like telcos, banks, and energy-related sectors, dominated the index composition. This however changed dramatically since 2015 when the internet sector emerged to become a key weight in the index, reflecting the altered nature of the economy where the sector’s contribution to the wider economy started to be recognised and was duly acknowledged with increased representation in the MSCI China index. The inclusion of the US-listed American Depository Receipts (ADRs) internet names in 2015 to the index was a key moment, and the sector’s index weight progressively grew over the years to reach a high of c. 40% in 2020.

Today in 2022, the internet sector still forms the largest component of the index (at c. 35%), while previous heavyweights like financials, telcos, and selected state-owned energy-related names (i.e. the “old economy” sectors) have shrunk in importance and weight (see Figure 2 which shows the evolution of the MSCI China index constituents since 2006).

Figure 2: MSCI China constituents (2006 to 2022)

Source: CICC, September 2022.

Why is the changing makeup of the index important?

Simply put, the “new economy” sectors trade at higher valuations. On the other hand, “old economy” sectors trade at lower valuations. Accordingly, with the composition of the MSCI China index today skewed towards the “new economy” names, the MSCI China index should trade at a higher PE multiple versus its longer-term historical average. As it is, the MSCI China index’s 5-year historical average PE stands at 12.6x while the 10-year historical average PE stands at 11.3x.

Notwithstanding the above, it should be noted that while the internet sector may be a high growth area, the period of excessively high growth rates, is probably behind us due to increased regulatory scrutiny in this space since 2021. While we do not foresee any further incrementally harsh regulation on the internet sector, enforcement of existing regulation will still be in place. The business model of becoming a super app or company is a thing of the past.

We expect modest growth for the internet sector going forward as its core businesses start to mature and new business drivers such as cloud computing have yet to be fully monetised. With more moderate growth, we believe the Chinese internet sector will not trade at the highs of the historical range until its new business drivers start to contribute more meaningfully.

China’s growth outlook, and potential re-rating catalysts

EPS growth is expected to come in at around 9.0% in 2022 and expected to rebound to 15.7% in 20231. There is also the potential for valuation re-rating next year closer to its 5-year historical average if China chooses to relax, if not exit its zero-Covid strategy sometime in 2023.

Geopolitics, policy setting, and property

On the political front, President Xi is expected to remain in office for a third term, with no major fundamental shifts in policy setting. “Common prosperity” is expected to remain intact and to dominate the agenda. Separately, climate-related, and nationally aligned goals (due to ongoing US-China relations) will continue to feature highly on the government’s priority list. “Traditional” tech sectors, like semiconductors (following national security considerations) as well as new industrials (like renewable energy) may benefit, as a result of top-down government driven policies.

For property, the policy tone has turned more supportive. This includes news reports that the Chinese regulators have asked state-owned banks to offer financing support to developers. Certain Chinese cities would also be allowed to adjust minimum first-home mortgage rates. These are positive developments, and steps in the right direction. That said, it will take time to restore homebuyers’ confidence and the policy announcement are unlikely to drive an immediate rebound in the housing market. Quality developers with stronger balance sheets are expected to be more resilient.

Conclusion

In summary, we believe that valuations for Chinese equities (MSCI China) at this point are attractive given they are trading at historical lows. There is re-rating potential, and the nearer term 5-year historical average which is trading at a higher valuation multiple versus the longer term 10-year historical average, should be more representative of the market’s inherent value, given how the index’s constituents has evolved to have increased weightage in the internet sector, in recent years.

1 Source: FactSet, October 2022.