Fullerton Singapore Value-Up Internship

Build your career in investment research with a 35‑week, high‑impact internship designed to develop future Research Analysts for the asset management industry. The FSGV Internship combines hands-on rotations, structured training, and mentorship to accelerate your technical and professional growth — and can lead to a full-time placement upon graduation, subject to performance and available openings.

What You Get from FSGV Internship

- Gain deep, practical experience across different asset classes through rotations in our Equities, Fixed Income and Multi-Asset teams

- Learn our end‑to‑end research methodology: from idea generation and modelling to stakeholder communication.

- Strengthen core foundations with curriculum aligned to attaining the CFA Institute Investment Foundations Certificate, as well as relevant systems training.

- Be coached by senior analysts and participate in technical meetings to sharpen your market awareness and analytical judgment.

Who Should Apply

- Undergraduates in Business, Economics, Finance, or related fields who aspire to become Research Analysts.

- Curious, analytical problem-solvers who can communicate clearly, collaborate well, and thrive in fast‑paced, data‑driven environments.

Programme Structure

- Duration: 35 weeks (first intake targeted for May 2026).

- Rotations: Two 4‑month rotations across Equity (EQ) and Fixed Income (FI); Multi‑Asset (MA) interns rotate within the Multi-Asset team across asset types.

- Training:

- Technical: Investment Foundations-aligned curriculum; Bloomberg, internal tools, and Fullerton Research Methodology.

- Soft Skills: Communication, business storytelling, critical thinking, emotional quotient, resilience, and time management via Go1 micro‑learning.

- Engagement & Coaching: Participation in investment forums; assigned senior analyst coach; midpoint and final evaluations.

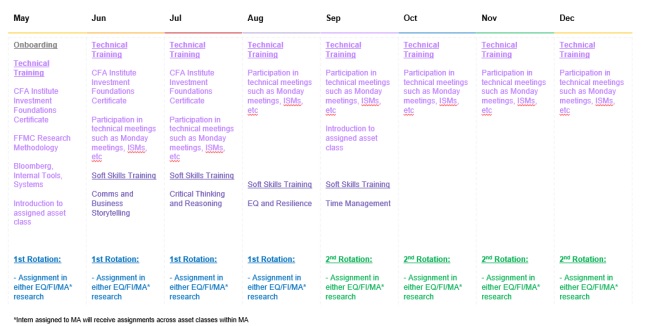

Here is the program schedule by month, the sequence of specific modules is subject to change:

Selection Process

The selection process for our 2026 intake will be integrated with the SG Value‑Up Equity Challenge held from January to April 2026 - an 8‑week paper trading qualifier via SGX’s InvestSG where top teams advance to a Stock Pitch final. Up to 10 students from the finalist teams may be shortlisted for the Internship Assessment, through which up to 5 students may be identified to be part of this programme.

Key Dates to Note:

| Event | Date/ Time |

| Registration Period | 10 December 2025 – 23 January 2026 |

| Qualifying Round (Online Trading Simulation) | 26 January – 6 March 2026 |

| Notification of Finalists | 12 March 2026 |

| Finals – Compulsory Briefing | 14 March 2026, time TBC |

| Finals – Deadline for submission of deliverables (equity research report, presentation slides, financial model) | 27 March 2026, 2359 |

| Finals – Presentation Day (closed-door session) | 2 April 2026, 1000-1500 |

| Awards Ceremony for three winning teams | 7 April 2026, time TBC |

| Internship Assessment Day

(for shortlisted students) |

9 April 2026, details to be shared later |

| Internship Period | May 2026 to December 2026 |

How to Apply

Applications to the 2026 intake is through participation in the SG Value-Up Equities Challenge 2026 only. For more information on the SG Value-Up Equities Challenge, please click here.

Start your journey as an investment professional with the FSGV Internship — learn from experienced analysts, build conviction, and make an impact that matters.