Executive summary

- US equities historically tend to be relatively stronger with a Republican Presidential win – they are seen as more pro-growth.

- Beyond who takes the White House, fundamentals are still critical in driving the longer-term direction of US markets.

- Factors like productivity, labour costs, corporate profits, US household strength, and the fiscal position, will have a strong bearing on markets.

- Our view is that both parties are keen on keeping the fiscal deficit restraint, not wanting it to ‘blow-out’ for fear of a high debt burden.

- A healthy fiscal position should keep US yields contained, supporting US equity valuations.

- Should Trump assume office for a 2nd term with a split Congress (Republicans hold the House and Democrats the Senate), this is expected to be neutral to positive for financial regulation, and negative for global relations and environmental policies. It is expected to be neutral for fiscal and monetary policy, infrastructure spending, and tax policies – these tend to be more influenced by underlying economic considerations.

Fundamentals can still trump politics

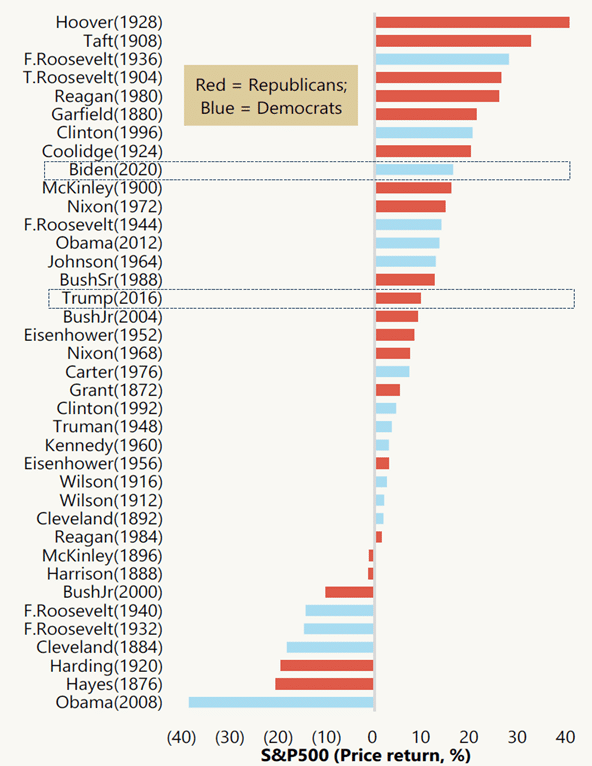

Historically the performance of US equities, in an election year, has been relatively stronger under a Republican presidential victory largely because they have a reputation for policies that are more pro-corporate than Democrats (see Figure 1). Such perceptions are reflected in their policy initiatives, where most recently, for example, The Limit, Save, Grow Act (April 2023) was the Republican’s proposal to raise the public debt ceiling (to give more headroom for infrastructure investment and lower taxes) and cut government consumption spending.

President Trump aligns with such views, being perceived as pro-business and employment, but US equities actually performed stronger in President Biden’s election year (see Figure 1). Trump’s election year (2016) broadly coincided with a favourable year for equity investors chasing value-stocks, while Biden’s election year (2020) was driven mostly by growth-stocks. Outperforming sectors in both election years were firms across communication services, IT, and materials1.

Regardless of which party governs, US macro fundamentals are always important in driving equity returns. After the Q1 2020 COVID slump and Q3 2020 rebound to trend, US equities were supported by strong corporate and household fundamentals i.e. improving productivity growth, low real unit labour costs, above average profits to GDP, very high household wealth, and robust consumption spending2.

These fundamentals are likely to remain important to the performance of US risk assets over the next few years irrespective of the 2024 election outcome. The consensus view is that US fiscal policy will remain generally neutral, adjusting toward countercyclical, for the economy. Any new significant stimulus plans will be constrained by budget and debt concerns.

Figure 1: S&P 500 returns in past election years

Source: FactSet, Jefferies January 2024

US fiscal stimulus reacts to the business cycle, while equities perform best under fiscal restraint

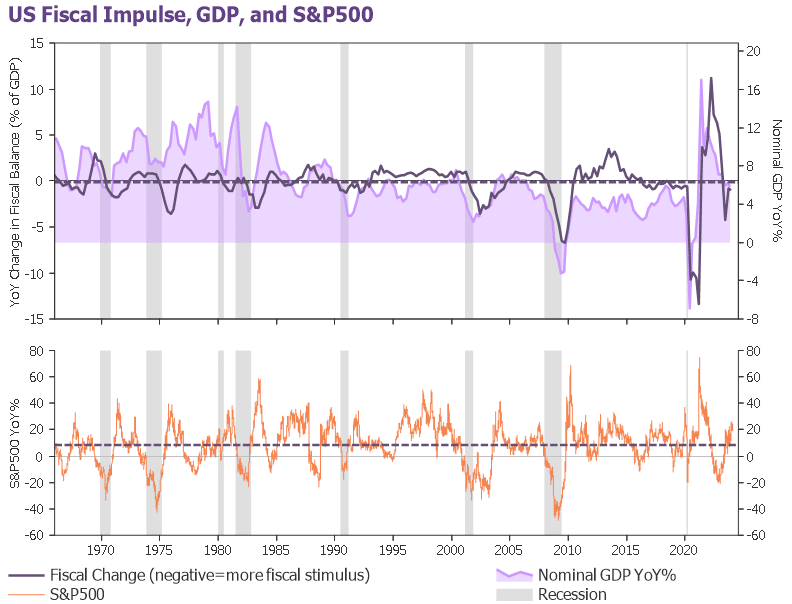

Figure 2 shows that, not surprisingly, US fiscal policy moves with the business cycle. Historically, when growth shocks on the downside there tends to be more stimulus. On average nominal GDP growth is at its trend and fiscal policy is neutral i.e. a zero fiscal impulse (see Figure 2). The neutrality of the fiscal impulse on average suggests that there is no bias across Democrat or Republican for sustained stimulus spending.

Figure 2: US fiscal stimulus, GDP growth, and S&P500 returns

Source: LSEG Datastream, January 2024

One period that stands-out in Figure 2 with strong equity market returns (above average) was 1995-2000, which correlated with a period of significant US fiscal policy restraint (i.e. the fiscal impulse was restrictive above neutral3). This fits with the argument that well-controlled government spending avoids ‘crowding-out’ private sector investment, and as a result, equities can potentially perform better than otherwise.

If the US fiscal deficit does not deteriorate any further, then yields can potentially hold around trend growth, without upward pressure on the risk premium

At the current juncture, regardless of which party governs the US, significant pressure will persist for the fiscal deficit to be contained and slowly improve over time (while increases in public debt are minimised). We already observe US politicians reacting to these pressures as President Biden is managing the unwind of strong fiscal stimulus back toward neutral (see Figure 2).

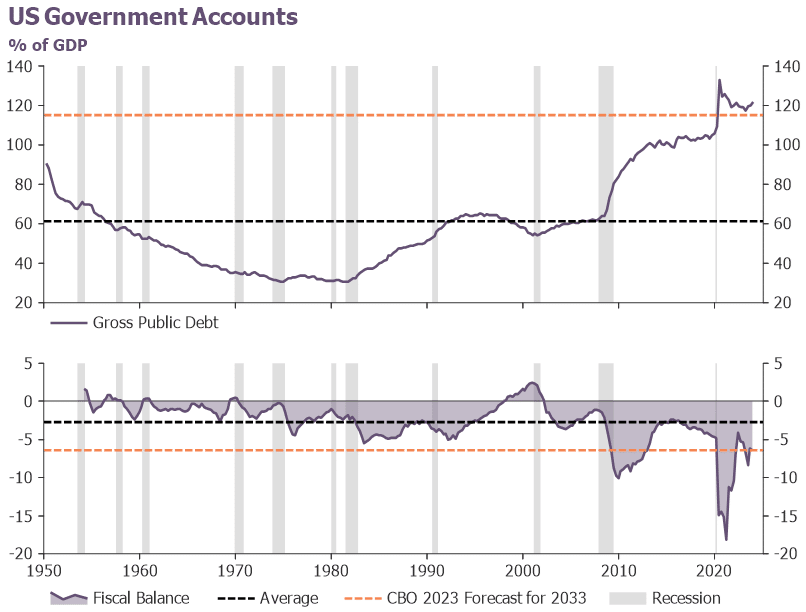

The latest annual long-term fiscal projections from the Congressional Budget Office (CBO, June 2023) suggest that if US real growth can average close to its trend (at 1.7% p.a. out until 2033) then the US fiscal deficit may be no worse than 6.4% of GDP and public debt to GDP can correct to 115% (see Figure 3). The CBO reports that if such fiscal outcomes can be achieved then the US 10y nominal yield can average around 4% p.a. over 2024 to 2033.

Figure 3: The US fiscal situation and potential outcomes to 2033

Source: LSEG Datastream, January 2024

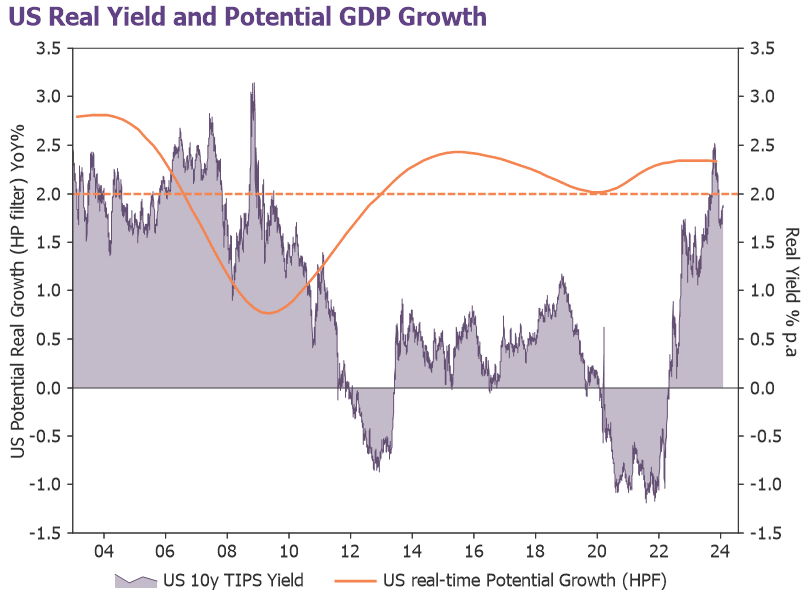

This implies that if US politicians can make sure the deficit is no worse than currently then there is a good chance of public debt stabilising. At the same time they can avoid placing undue upward pressure on the yield risk premium. As a result, US real yields may fluctuate around trend growth (as we are seeing evidence of already, see Figure 4) and the nominal 10y yield can potentially hold around 4% (i.e. the average 10y real yield plus the Fed’s 2% inflation target).

Figure 4: US real yields may average around trend growth

Source: LSEG Datastream, January 2024

The big fiscal challenge for the US comes after the end of this decade

The big fiscal challenges that the US faces, for long-term fiscal sustainability, will hit after 2030. If current policy settings do not change dramatically then US public debt can become explosive: surging toward 180% of GDP by 2053 (see CBO June 2023). This will be a significant problem, dictating substantial fiscal reforms toward higher taxes and less spending, for whoever governs the US toward the end of this decade.

Summary of macro themes and possible implications from US election outcomes

Current situation:

Democrat President (Joe Biden),

Republican House of Representatives (6 seat majority), Democrat-controlled Senate4

Scenario considered (hypothetical situation of a Trump victory):

Republican President (Donald Trump, second-term),

Republican House of Representatives, Democrat Senate

| Impact | Macro Themes | Possible implications from US election outcomes |

| Neutral | Market Volatility |

|

| Neutral | Sector-specific effects / Tactical Positioning |

|

| Neutral to Positive | Financial Regulatory Environment |

|

| Negative | Global Relations |

|

| Neutral | Fiscal and Monetary Policy / Interest Rates |

|

| Neutral | Infrastructure Spending and Onshoring |

|

| Neutral to Negative | Environmental Policies |

|

| Neutral | Taxation Changes |

|

1 Source: LSEG Datastream, January 2024.

2 For more detail on Fullerton’s assessment of US fundamentals and the outlook for risk assets please see: https://www.fullertonfund.com/wp-content/uploads/2024/01/FIV-Q1-2024_FA_FINAL-C.pdf.

3 The period coincides with Democrat President Bill Clinton, who when he left office in Jan 2001 achieved the highest-approval rating (at 66%) of any US president in the history of the Gallup Poll (since 1937). The second highest ranking was achieved by Roosevelt (65%), while Trump scored 34%.

4 Source: https://ballotpedia.org/, as of 31 January 2024. The 435 member US House of Representatives comprises of 219 Republicans, 213 Democrats, and 3 vacancies. The 100 member Senate comprises of 49 Republicans, 48 Democrats, and 3 Independents. The Democrats control the Senate because the three independents tend to support them.

5 Source: LSEG Datastream, January 2024.

6 Source: ‘Wall Street bank bosses warn lawmakers of economic toll from new rules’, 6 December 2023 Reuters News.

7 Further protectionist policies may reinforce the shifts in global trade and investment flows that Fullerton has highlighted. For example, protectionism seems to be creating stronger risk asset performance across countries that produce high value-added outputs, and have favourable ties to the US, or to China’s supply-chain. See https://www.fullertonfund.com/wp-content/uploads/2024/01/FIV-Q1-2024_FA_FINAL-C.pdf for more detailed discussion.

8 Source: The White House.

9 The IRA (2022) contains $500bn in spending and tax breaks that aims to curb inflation by increasing efficiencies with cleaner energy, lower carbon emissions (over the next 10 years), reduce healthcare costs, and lower the fiscal deficit (in part by improving taxpayer compliance. Source: McKinsey ‘The Inflation Reduction Act’ October 2022).

10 Treasury Secretary Yellen has said that a second Biden administration would seek to retain the tax cuts for 99% of US income earners (that is the proportion below the $400,000 p.a. income threshold). Source: Bloomberg News, 26 January 2024.