Executive Summary

- Asian fixed income is steadily gaining recognition as one of the few asset classes where a confluence of factors are reshaping the outlook.

- For institutional investors the case for investing in Asian local currency bonds is becoming more compelling.

- The asset class now offers an attractive mix of technicals and fundamentals while providing meaningful diversification benefits.

As we progress through 2025, Asian fixed income is steadily gaining recognition as one of the few asset classes where both structural evolution and cyclical dynamics are reshaping the outlook for returns, diversification, and policy flexibility.

For institutional allocators in the region, the case for increasing exposure – particularly to local currency bonds and FX – has become more grounded, supported by a convergence of favourable fundamentals and broader global portfolio shifts.

Asian fixed income now offers a potentially compelling mix of attractive yields, supportive currency dynamics, and stable technicals amid a backdrop of global capital rotation.

The region provides meaningful diversification from developed market fiscal and policy risks, while also offering insulation from rising term premiums and elevated duration supply pressures seen in major DM bond markets.

With relatively sound macro fundamentals, prudent fiscal management, and increasingly mature institutional investor bases, Asia is well-positioned to manage future volatility with greater policy flexibility.

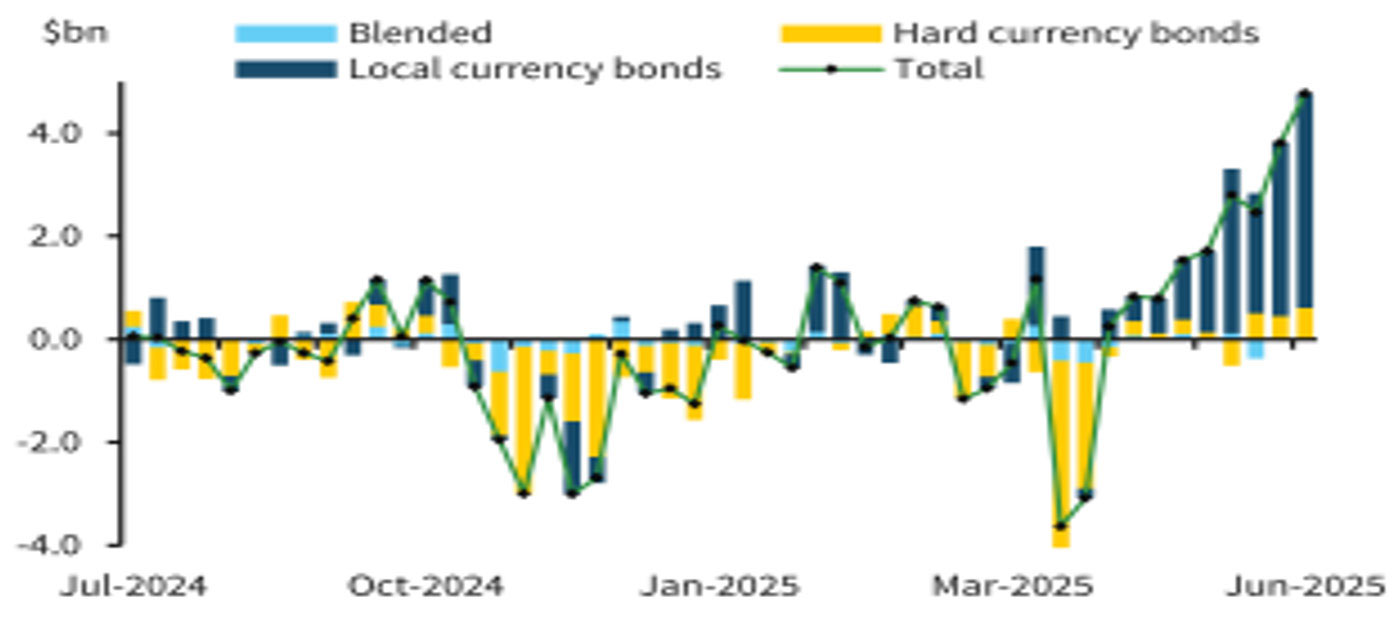

Importantly, the theme of de-dollarisation and reserve diversification is gaining tangible traction. What was once a long-term expectation is now reflected in observable flow trends, further reinforcing the role of local currency exposure and FX as potential sources of excess return in global portfolios.

De-dollarisation drives flows into local currency EM bonds

Source: Barclays, June 2025

Structural tailwinds: A new regime for Asian duration and currency

The end of USD exceptionalism and asset rotation

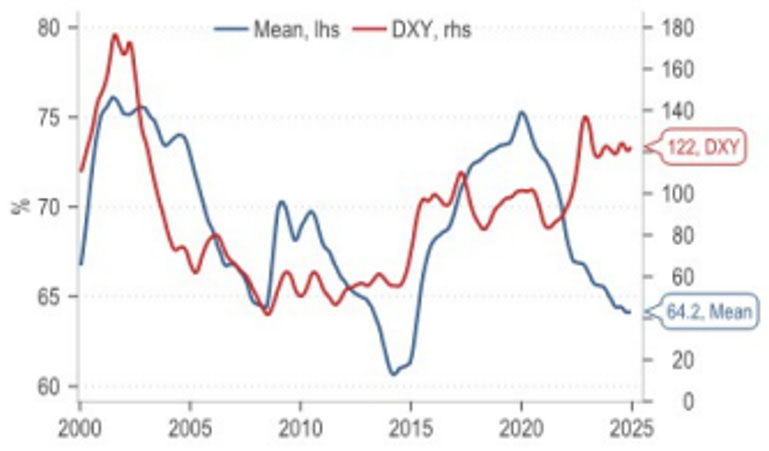

After years of accumulating USD-centric reserves and portfolio assets, Asian investors, sovereigns, and corporates are gradually shifting toward greater diversification in 2025, with emerging signs of repatriation and a more balanced currency allocation.

Diminishing US rate/growth outperformance, rich valuations in the Dollar, and renewed US policy/political uncertainty are catalysing a flow rotation out of over-owned US assets. We believe this is a secular, not merely cyclical phenomenon, now manifest in both hard data (reserve composition changes, rising FX hedge ratios, corporate USD-to-local conversions) and market pricing.

Percentage of USD in Asian FX reserves is falling

Source: JP Morgan, June 2025

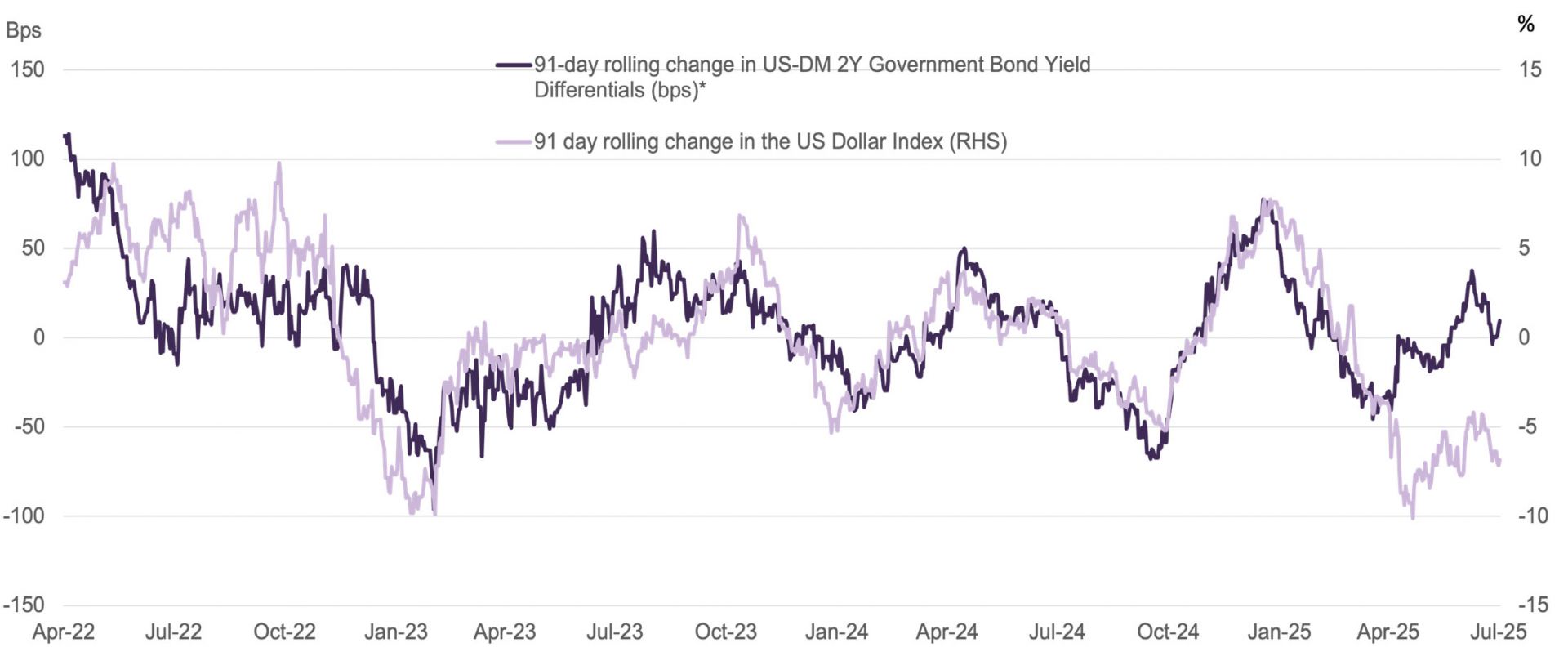

USD loses ground even as U.S. rate premium persists

Source: Bloomberg Fullerton, July 2025. * This is calculated based on the 91-day rolling change in the weighted average yield differential between 2-year U.S. Treasury and 2-year government bonds of Germany, Japan, the UK, Canada, Switzerland, and Sweden

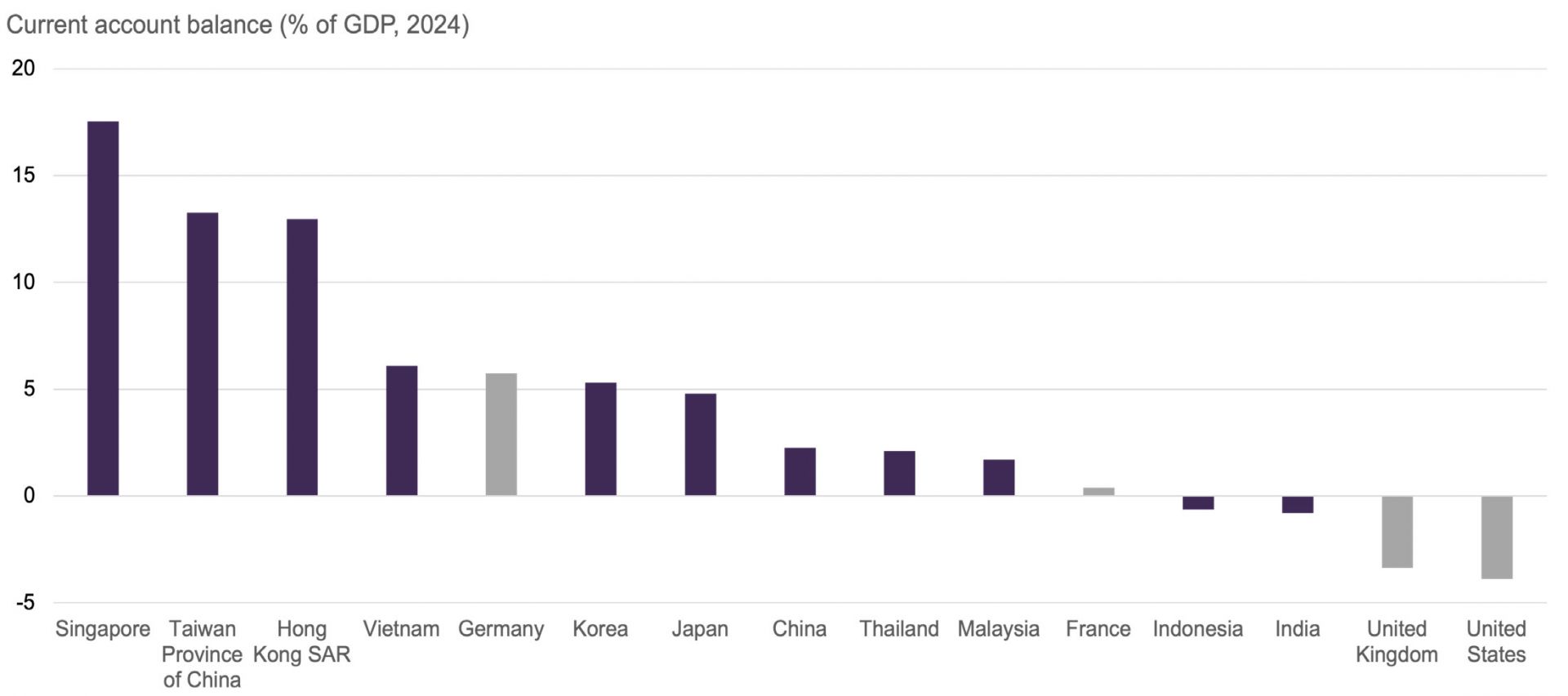

Asia’s policy space and institutional strength

Unlike most DM or EM regions, Asian economies enter this regime with healthier fiscal positions, high policy credibility, and a measured move toward more flexible and prudent macroeconomic frameworks, including flexible exchange rates, inflation targeting, and responsible fiscal management. This has allowed Asian policymakers to retain policy flexibility and to support growth during downturns, and, most importantly, maintain a larger buffer to absorb external shocks. The difference is evident: in 2025, policy rates across Asia are structurally higher than before the global financial crisis, yet core inflation remains well contained and external accounts are solid. As a result, Asian central banks now have the ability to smooth economic cycles in a measured, proactive way, rather than having to react defensively to crises.

Many Asian economies run current account surpluses

Source: IMF latest database April 2025

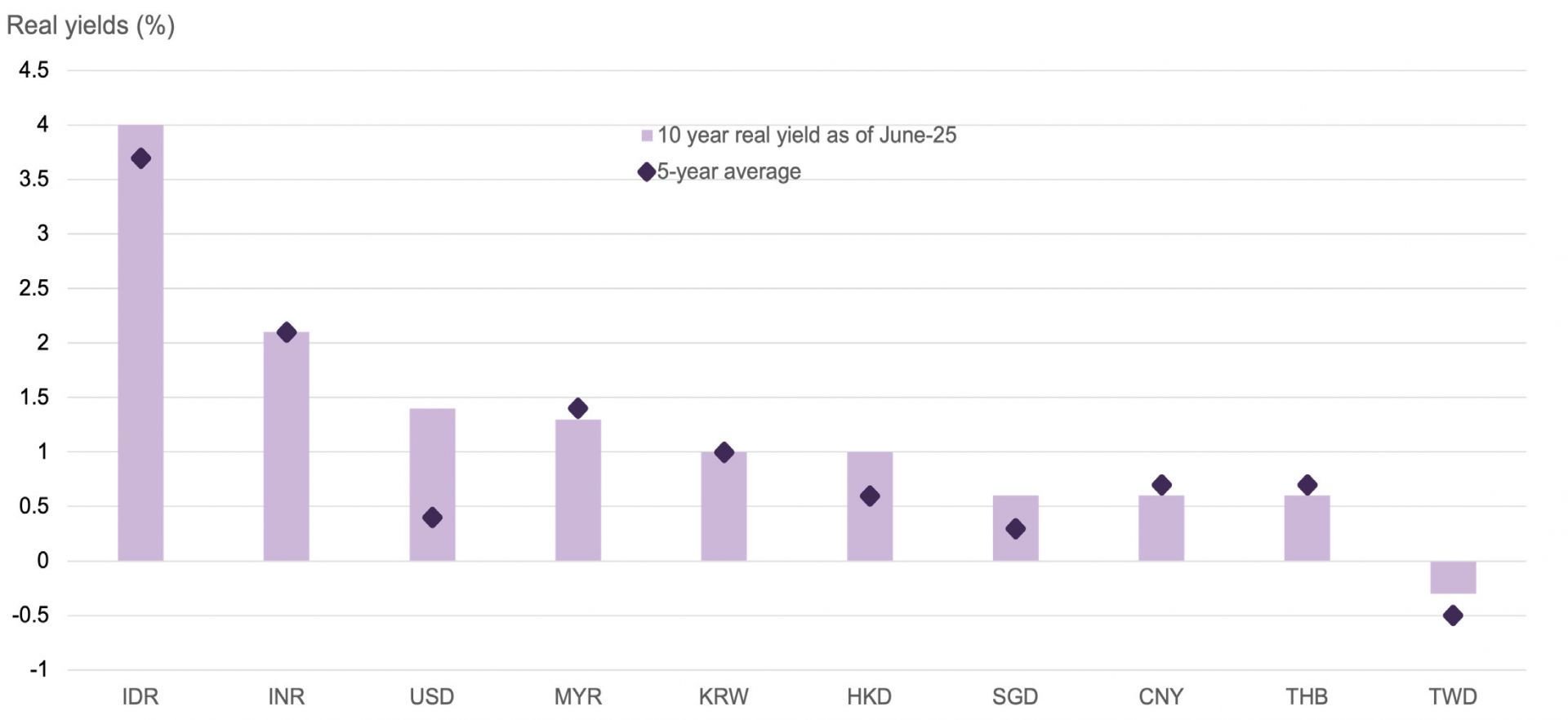

Asia real yields are comparable versus the US

Source: Bloomberg, Fullerton, June 2025

Duration and FX as structural sources of return

The traditional beta to US Treasuries is weakening as Asian local yields become less correlated to US/global core moves – thanks both to durable local bid (insurance, pension, SWF), and to deeper, more liquid domestic markets. Meanwhile local currency performance – previously driven largely by cyclical carry and broader risk sentiment – is increasingly supported by steady USD outflows, rising hedge activity, and a gradual shift towards viewing Asia as a core allocation within global portfolios.

Diversification in a fragmented world

The Asia fixed income opportunity also represents effective diversification. Asian institutions running legacy exposures to US or core DM rates and credit can potentially harness high quality local currency bonds and active FX to offset US fiscal tail risks, EM idiosyncratic shocks, and even global risk-off episodes.

Cyclical context: Looking into 2H 2025

Navigating diverging rate paths in Asia

Across Asia, the initial rate cuts and front-end rallies of 1H 2025 are giving way to more nuanced rate paths. We maintain an overweight duration stance in selected markets where policy easing is either underway or firmly expected, particularly in Korea, Thailand, Malaysia, and Indonesia. Conversely, we remain underweight duration in markets where valuations appear rich relative to fundamentals, such as China, where policy rates have more limited downside and room for further bond yield compression is less. This selective approach allows us to balance yield capture with prudent interest rate risk management across the region.

Shifting curve dynamics and relative value

Opportunities are increasingly found in curves too. 2s10s steepeners in Korea (reflecting fiscal supply risk), belly/back-end bias in Malaysia (on policy patience), and tactical flatteners as carry/risk premiums compress. The decoupling from US term premium is a strategic advantage, but careful positioning is required as global duration risk may reassert itself intermittently.

FX differentiation as a return engine

While the USD’s secular decline is a macro anchor, intra-Asia relative valuation differentiation is also key.

Within the Asian currencies, Malaysian ringgit (MYR), Singapore dollar (SGD), and South Korean won (KRW) stand out, each with substantial accumulated USD assets, room for FX repatriation/homeward flows, strong external positions, and policy regimes that favour currency stability.

The Chinese renminbi (RMB) is increasingly assuming a defensive role in regional markets, akin to the Japanese yen. Managed within a narrow band and supported by a policy focus on domestic stability, the RMB has evolved into a low-volatility, stable funding currency. This makes it a useful tool for regional carry strategies and a potential safe-haven component in multi-currency portfolios, particularly during periods of heightened global volatility.

In contrast, the Indian rupee (INR) and Indonesian rupiah (IDR) present a more nuanced picture. Both currencies are underpinned by long-term structural reforms and improving macro fundamentals, yet they offer comparatively less tailwind from USD conversion flows. Their performance tends to be more domestically driven, shaped by factors such as economic growth, inflation dynamics, and political developments. As a result, INR and IDR behave more idiosyncratically and are less directly tied to the broader de-dollarisation flows seen across the region.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. Any information on specific securities is for illustration purpose only and does not represent Fullerton’s current view of the security or constitute any recommendation.

The audio(s) have been generated by an AI app