Executive summary

- Rising intra-Asian trade over the past two decades has led to the emergence of a robust logistics sector in Asia.

- Increased e-commerce activity has further contributed to this trend.

- The vibrant logistics sector in Asia has also added to the growth of various industries linked to the sector, from container shippers to aviation-related players, freight forwarders, and port operators.

- There is a long growth runway in some of these industries. Most of the incumbents in this space operate with large CAPEX outlays, and have significant scale. As such barriers to entry are high.

- Notwithstanding the above, the industry has to be watchful of disruptive forces that could materially alter the operating landscape and its profitability outlook.

- In the near to medium term, increased demand from Covid re-openings is supportive but there are also challenges from rising fuel costs, supply chain complexities, and higher compliance costs from increased green energy-related regulation.

Rising intra-Asian trade has spurred a vibrant logistics sector in Asia

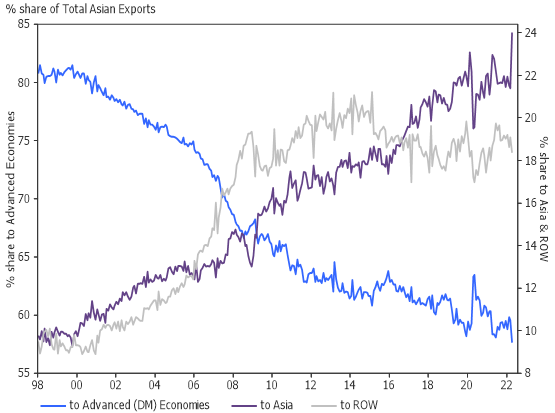

One of the benefits of rising intra-Asian trade over the past two decades as a result of the region becoming more interconnected, has been the emergence of a robust logistics sector in Asia (see Figure 1 that shows the trend of rising intra-Asian trade). Rising e-commerce activity and transactions in the region, has also contributed to this development.

Figure 1: Asia’s exports to various blocs: trading less with Developed Market economies and more with Asia

Source: Refinitiv Datastream, August 2022

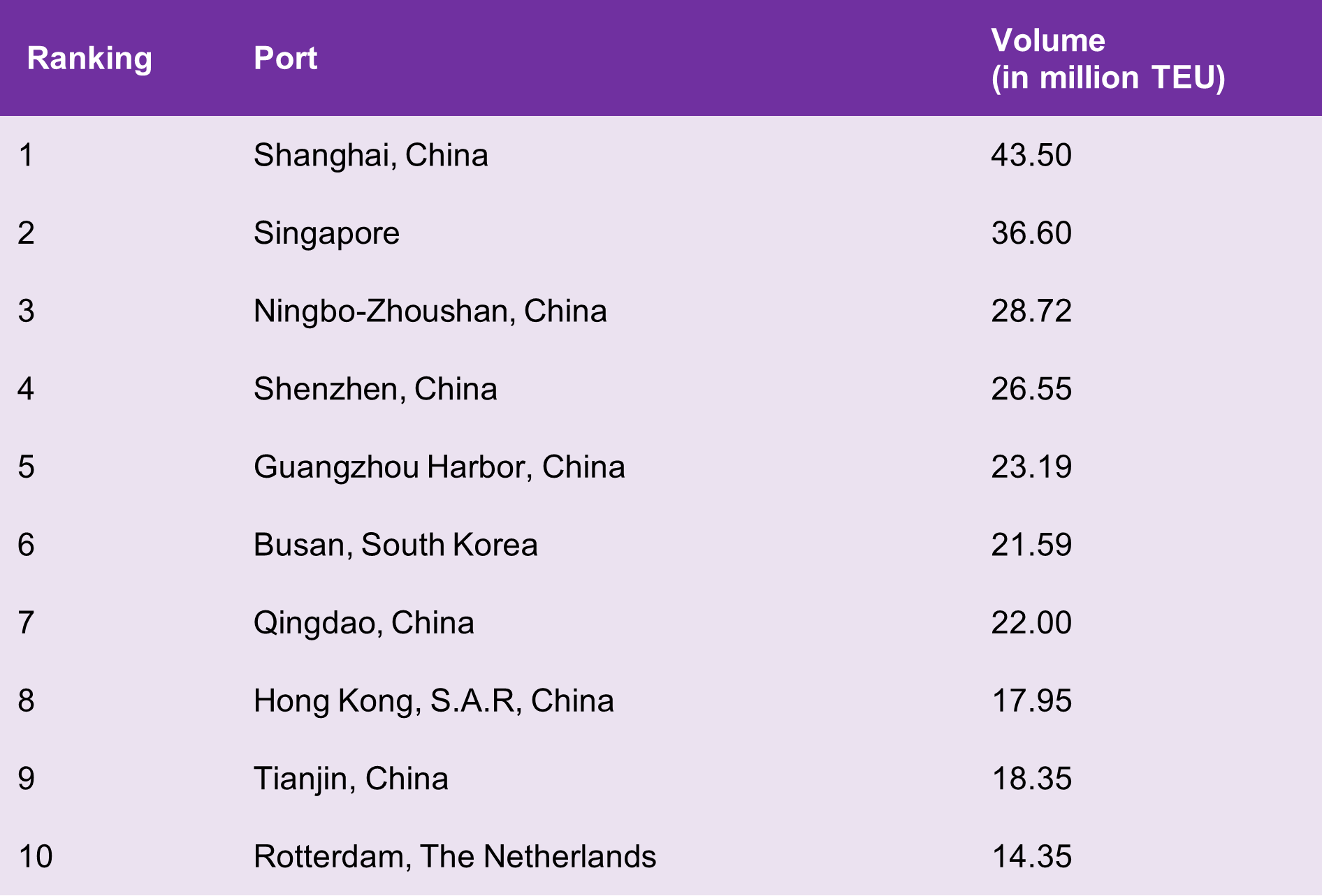

As it is, Asia Pacific’s share of global merchandise trade was valued at 41% of the world’s total exports and 36.8% of global imports in 2021^. Asia is also home to nine of the ten busiest container ports in the world in 2020 (as measured by container terminal traffic), with six ports from China in the list and one port each from Singapore, Korea and Hong Kong occupying the remaining three slots* in the global top nine ranking (see Figure 2).

Figure 2: 2020 Container Traffic Volume

Source: World Shipping Council, 2022

This strong trade volume and activity has given birth to numerous vibrant peripheral industries within the logistics sector in Asia, ranging from container shipping companies, to aviation, freight forwarders, port operators, as well as cargo handlers, and express parcel delivery handlers, to name a few.

Beyond the structural rise in trade and shipping volumes, efficiency gains and higher value-add from increased automation across the industry is also enhancing profitability.

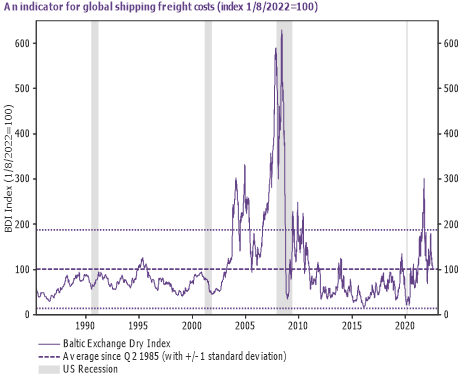

Outside of the long-term structural reasons underpinning the sector, recent economic re-openings from Covid induced lockdowns across the region, are also buoying freight prices, which is a near to medium term lift for the logistics-related sector. Incidentally, global shipping freight costs have recovered significantly since the Covid driven recession, and have now settled back to around its historical average (see Figure 3).

Figure 3: Baltic Exchange Dry Index

Source: Refinitiv Datastream, August 2022

Notwithstanding the benefits from longer-term structural and cyclical trends, there are also challenges facing the industry such as increased costs pressures from fuel price increases, and possibly also longer-term challenges in terms of how the industry addresses its ESG-related practices when it comes to key issues like labour management, and other critical topics like de-carbonisation.

As to the operational dynamics of selected key players in the industry such as port operators, and shipping companies, the scene is dominated by a few players with sufficient scale where large capital investments are required, and the barriers to entry are high. As such, it may be difficult for new entrants to come in and take market share away from the incumbents. Notwithstanding this, like any other industry, it needs to be aware of unforeseen disruptive forces that could materially alter the operating landscape and profitability outlook of the sector going forward.

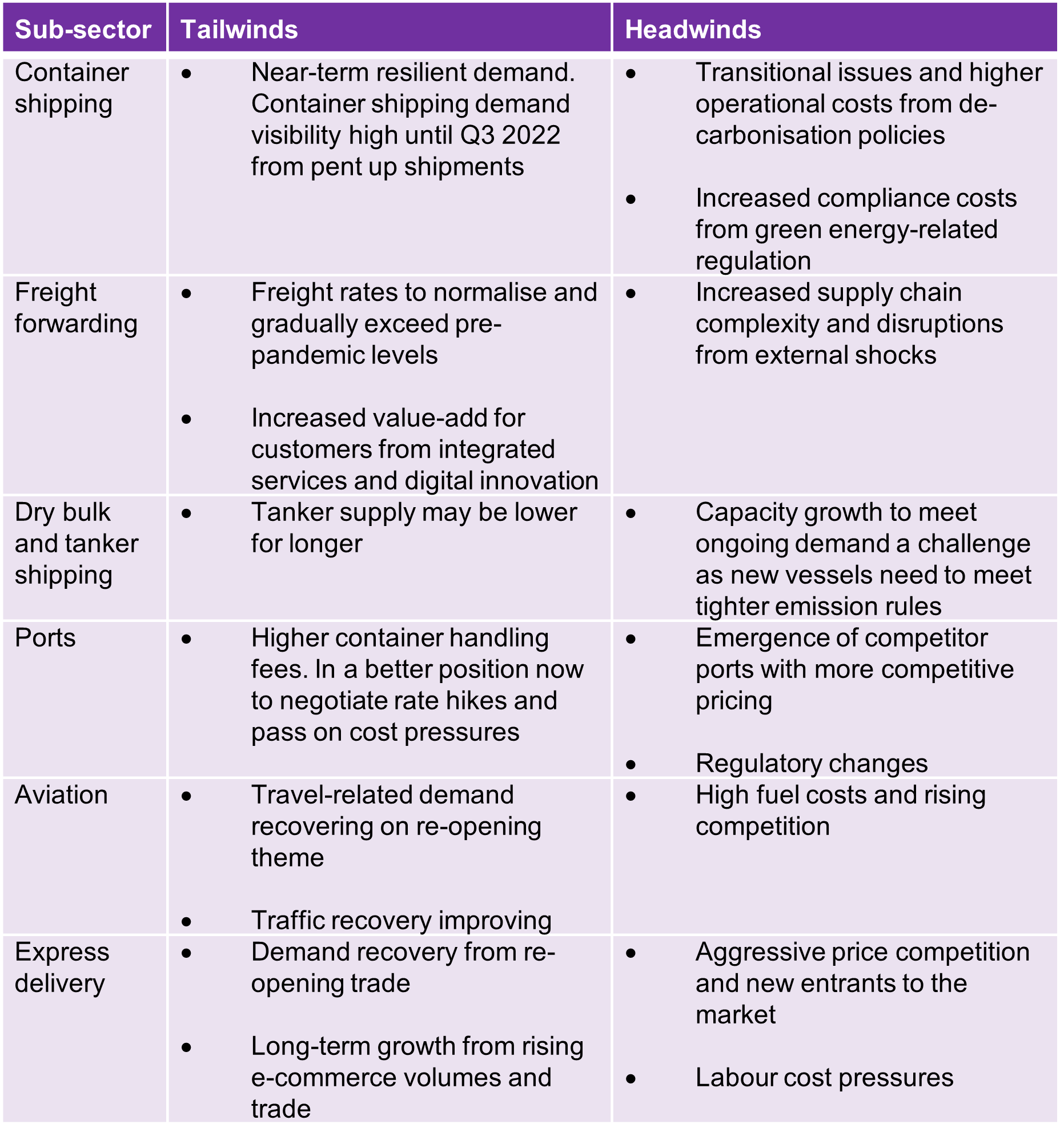

In the near to medium-term however, the table below (see Figure 4) summarises some of the tailwinds and possible headwinds facing the various sub-segments of the logistics industry at this point in time.

Figure 4: Near to medium-term headwinds facing the logistics sector