Executive summary

- Investors should consider the rationale, rather than the rhetoric from the President’s actions. By and large, he is anti-inflation, anti-government debt, and pro-US earnings growth and jobs creation.

- The administration may be more “tariff soft” on countries that are key suppliers of critical US imports for production but tougher on countries seen as a competitor.

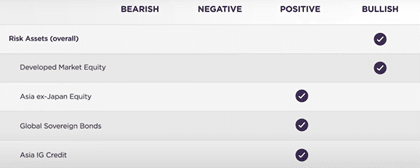

- Tariff implementation aside, we are still bullish on global risk assets and Developed Market (DM) equities, with a positive outlook for Asia (ex-Japan) equities and fixed income.

- Countries hit with tariffs have shown they can defend their ground – in some cases, expand their global export trade share, thus possibly mitigating sustained growth headwinds.

- Tariffs are not expected to be US inflationary – consumers can switch their spending habits to work around the tariffs.

- The tariffs could be positive for US stocks with strong domestic centric supply-chains and revenues, and negative for foreign equities relying heavily on US demand.

- Investors can manage against tariff-induced volatility by focusing on areas with robust earnings, strong innovation, and limiting their direct exposures to companies with large export shares to the US.

- Asian credit markets are relatively resilient, with direct trade tariff impacts expected to be limited – most Asian issuers have minimal exposure to US-based revenues.

What happened?

On February 1, President Trump announced a 10% tariff on imported goods from China, while Canada and Mexico were slapped with 25% tariffs, but with a lower 10% tariff on Canadian energy and oil1. Canada and Mexico however “earned” a 30-day reprieve on the tariff implementation following concessions from both countries that they will adopt stricter border controls and tighten crime enforcement (particularly on the flow of illicit drugs) with the US.

Simultaneously, both Canada and Mexico announced they were preparing retaliatory tariffs on US goods, while China added it would take “necessary countermeasures”. It subsequently followed up with a 10% tariff announcement on US crude and agricultural machines, and 15% tariffs on US coal and LNG. These so far restrained measures from China appear consistent with how it approached the tariff tensions with the US back in 2018. Additionally, the 10% tariff on China is much lower than the rhetoric that had been emanating from Trump’s election campaign trail2 (although it is still significant given the tariffs against China that were already in effect since 2018).

The art of the deal in action?

It seems that Trump is playing the tariff card as a means to an end rather than an end in itself. He could be using this as a negotiation tactic to extract concessions from key trading partners – as seen above from Canada’s and Mexico’s announcement to be more stringent on border security and the curbing of illicit drugs. Other nations like India “falling in line”, with promises to revisit its own tariff regime, making pledges to maintain the US dollar as the trading currency of choice, and offering to take in some unlawful migrants from the US, to avoid a trade war, could be indicative of the sort of desired outcomes the President is looking to achieve.

Investors should consider the rationale, rather than the rhetoric, behind President Trump’s actions and policies. He is anti-inflation, anti-government debt, and pro-US earnings growth and jobs creation. These factors can be US dollar supportive and the Trump administration seems to appreciate that the best tonic for US manufacturing and domestic production is cheap imported materials, lower costs, and higher earnings, which creates jobs. With the “art of the deal” to secure concessions, ultimately being “tariff-soft” on the Americas and tougher on China is in the US’ best interest. This is because the Americas are key suppliers of important imports for US production, while China is a competitor.

The tariff implementation does not change our outlook for global risk asset performance in 2025

As presented in our Q1 2025 Fullerton Investment Views3, we are bullish on global risk assets and Developed Market (DM) equities, with a positive outlook for Asia (ex-Japan) equities and fixed income.

Figure 1: Summary of Fullerton’s Views (12 months ahead)

Source: Fullerton Fund Management, Feb 2025. Views may be subject to change without prior notice.

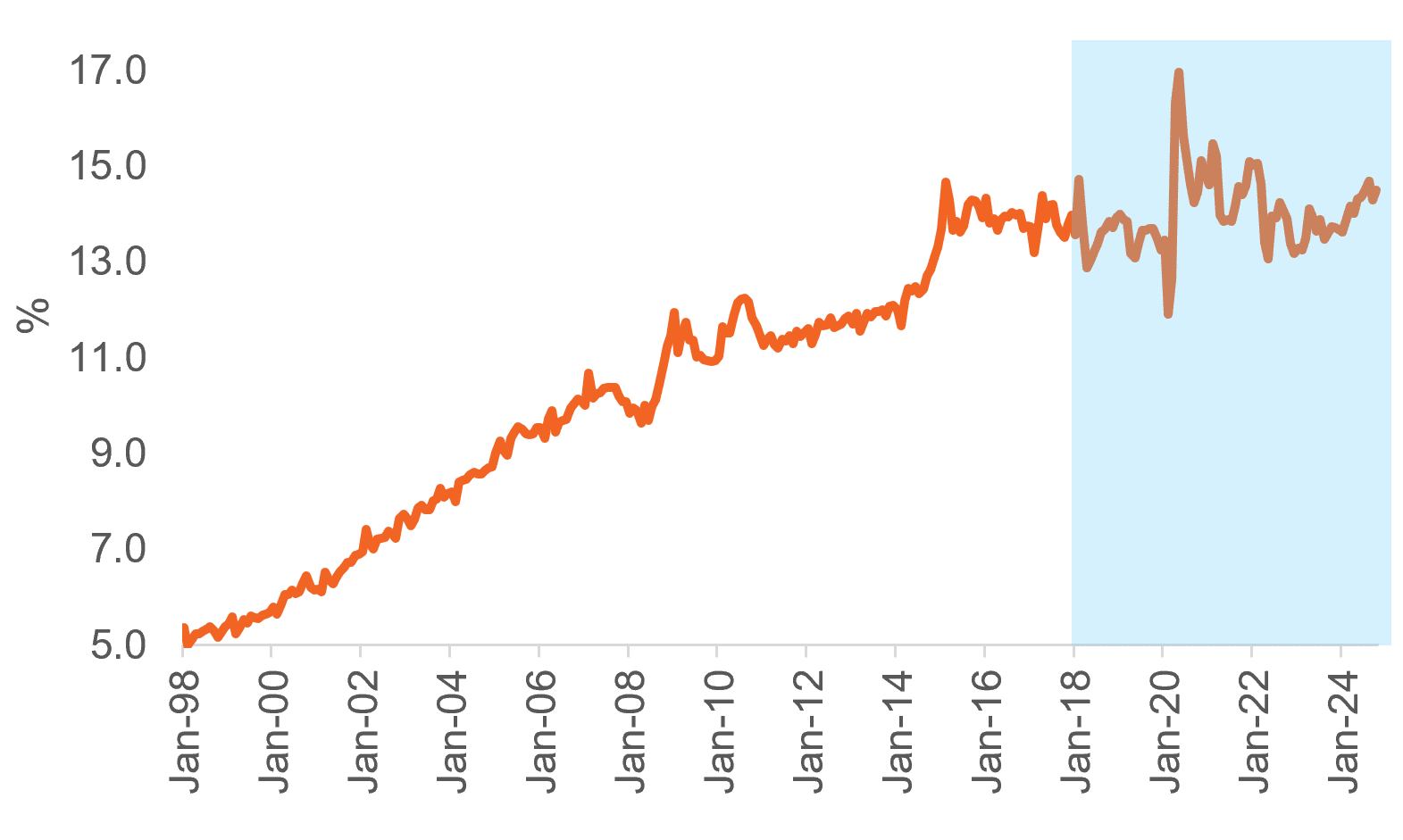

This constructive view is predicated on the notion that countries hit with tariffs have shown that they can defend their ground, and in some cases expand, their global export trade share – thereby mitigating any possible sustained headwinds for growth. In China’s case, despite the onslaught of US tariffs that started during Trump’s first stint in office (from 2018), it has managed to maintain its global export share which subsequently rose to the mid-teens percentage level by Q4 2024 (see Figure 2). This is because China has benefited from improving global export prices, its competitive exchange rate, and the ability to sell more to Asia and Europe.

Figure 2: China’s Share of Global Exports – Jan 1998 to Oct 2024 (in % terms)

Source: LSEG Datastream, January 2025.

It is also important to appreciate that if a product is a “must-have” for the US, and China/Asia/Europe have key products in such areas, then it will be delivered and the US consumer is the loser – they pay more, but buy less of something else.

This leads to a key reason why tariff impacts on the US economy can be insignificant – because consumers switch their spending habits, reducing any inflationary impacts. A stronger dollar also offsets any imported inflation effects, and thus the growth trajectory can be maintained.

However, there can be near-term cyclical adverse impacts to investor confidence across countries, especially those hit with tariffs. This often plays out across currency markets, but any resulting depreciation can actually boost export competitiveness over time. US equities also fell on the tariff announcements possibly because investors’ immediate concerns were that US manufacturing will be hurt by higher costs of imported raw materials (especially from the Americas). However, by 5 February the S&P500 had mostly recovered all the losses from Monday’s tariff-driven selloff4.

While aggregate macro impacts can be neutral, there can still be sector disruptions and divergence in performance. For example, in our Q1 2025 Fullerton Investment Views5 we noted that US policy shifts toward more intense protectionism could prove positive for US stocks (notably those with domestic centric supply-chains and revenues) and negative for foreign equities (especially for firms that rely on US demand). But such potential headwinds for returns from foreign companies that depend on US demand are not universal – even with higher tariffs, earnings can be defended by competitiveness and market power.

Investors can manage their risk by being selective, focussing on areas that exhibit robust earnings, strong innovation, and limiting their direct exposures to companies with large export shares to the US that do not have much market power (e.g. firms selling generic rather than differentiated or creative products).

Amid this backdrop, Asian credit markets stand out as a relatively resilient asset class, with direct trade tariff impacts expected to be limited. We observed that the majority of Asian credit bond issuers have minimal exposure to US-based revenues, thus insulating them from first-order trade shocks, while second-order effects – such as weaker business confidence and broader market sentiment, may have a more indirect influence on valuations and investor positioning.

A key structural strength of Asian credit is its high proportion of government-related issuers – approximately 58%6 of the market has some form of government ownership or backing. Given that major Asian economies hold investment-grade sovereign ratings, this serves as a buffer against external shocks, reinforces market stability, and helps keep downgrade risks contained.

We believe the Fed’s policy settings will remain data dependent and they will evaluate all of Trump’s policies, from tariff actions to government spending cuts, this year. Even before US fiscal policy became an issue again, US PCE inflation ended last year higher than expected (2.6% YoY in Dec, up from 2.1% YoY in Sep), and as a result the Fed revised-up its 2025 inflation outlook (and postponed a return to the 2% target into 2026). The Fed presented its view of less rate cuts for 2025 (than flagged in Sep) with the policy rate reaching 3.9% by year-end (which remains the view priced-in by the US forward market, as at 5 Feb). What the Fed will be encouraged by now is that its inflation nowcast has fallen back to 2.2% YoY (as at 5 Feb), and forward-market inflation expectations remain contained at 2.3%.

2 On the election trail, Trump was flagging 60% tariffs on all US imports from China. Source: AP News, 7 Nov 2024.

3 Based on JP Morgan Asian Credit Index, as of December 2024.

4 Source: Bloomberg, January 2025.

6 Based on JP Morgan Asian Credit Index, as of December 2024.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

The audio(s) have been generated by an AI app