Executive summary

- The early stages of the market impact of the Iran-Israel conflict thus far has mostly been confined to the energy markets.

- For now, risk appetite is well-behaved. Investors are not overly concerned – as seen by the mild reaction in the S&P 500 VIX levels and S&P 500 put-call ratio trend.

- Surges in oil prices are expected to be transient and unlikely to have a permanent impact on global inflation.

- There are other significant structural forces applying downward pressure on global prices – from China’s deflationary scenario to US productivity gains.

- From historical observations, we note that geopolitical shocks tend to trigger short-term, limited reactionary impact, before returning to their underlying trends.

On 18 June 2025 Iran and Israel launched further missile strikes at each other, as the aerial war between the two long time enemies entered its sixth day. According to media, US President Trump has gone so far as to call for Iran’s “unconditional surrender” which may have added to investors’ confidence that any conflict may not prove too stressful for too long1.

Fullerton maintains its positive outlook on global risk assets as presented on 29 April2

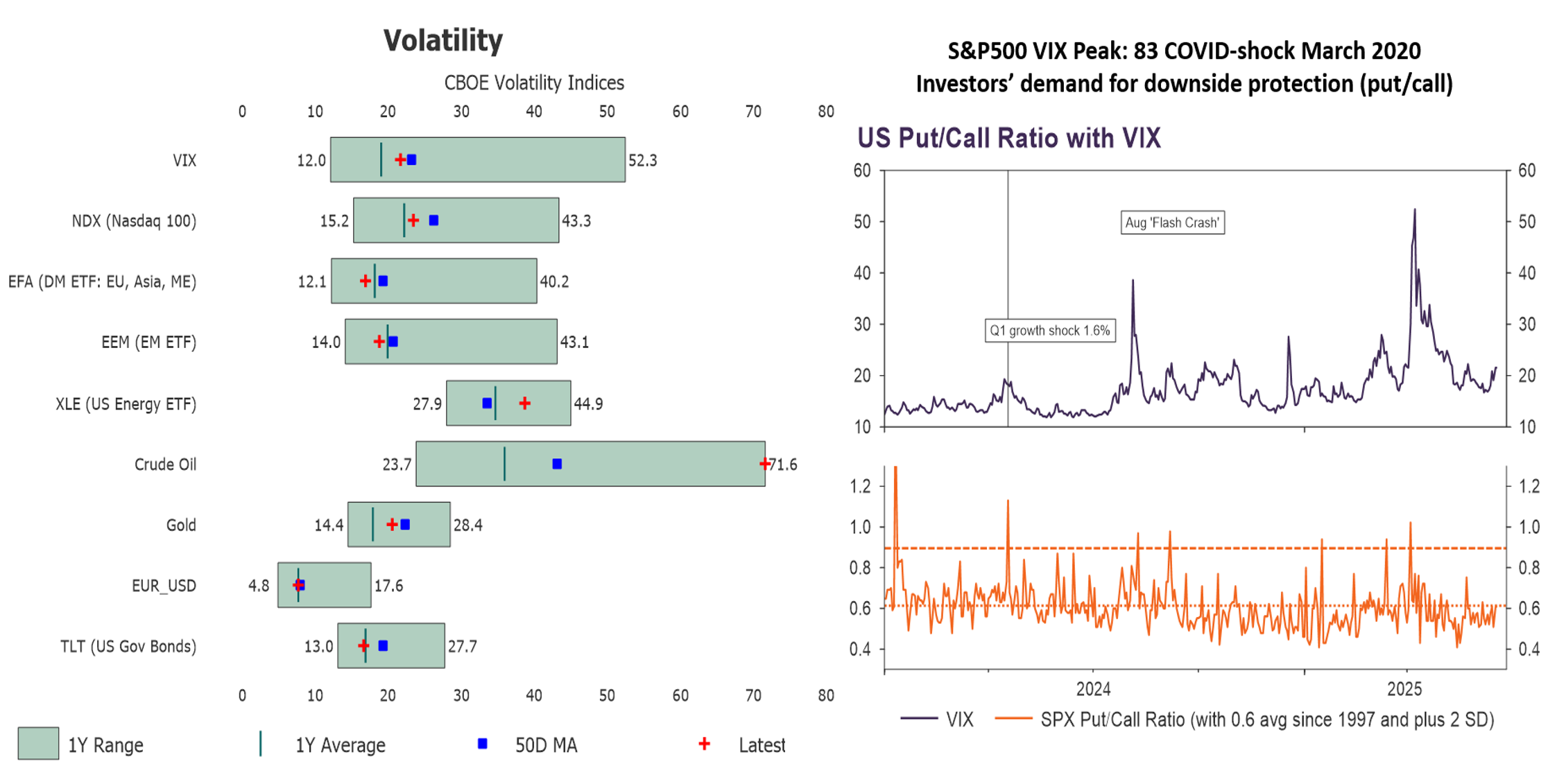

As the conflict unfolds the key signpost to watch for potential investment stress is volatility across risk-asset prices (see Figure 1). So far, investor concerns are isolated to oil prices – where volatility has surged to a 12-month high. But what is most encouraging is that the US equity market “fear index” (the VIX) remains contained. Furthermore, there is limited demand by investors for downside protection as the SPX put-call ratio remains around its average levels.

Figure 1: A key signpost to monitor is adverse contagion across asset classes

Source: LSEG Datastream, June 2025

So far stress and volatility are contained to the Crude Oil market. The most important metric for investor confidence – the VIX (or ‘fear index’), remains around its average (left-side chart, top bar and right-side chart, top panel).

In addition, demand for downside risk protection from investors (the SPX Put/Call Ratio) is also still around its average level (right-side chart, bottom panel).

Investors can be confident that this latest geopolitical conflict in the Middle East can be contained and prove not too stressful for too long – because:

- Firstly, Israel and the US are very credible military powers, and Iran is in a weakened state3. While oil prices could spike significantly on a higher risk premium this may not be significant nor sustained for long enough to stress growth and risk asset returns.

- Secondly, any oil price pressures into inflation may be more muted than some fear because the environment today is very different. The US is the largest oil producer in the world by far, and the third most important oil exporter4. Therefore, global oil supply flexibility, combined with the credibility of US military and political backing, can help mitigate any significant and sustained oil price pressures. At the same time, global inflation is still under significant downward pressures from US productivity growth and China exporting deflation.

Fullerton has also noted before that when geopolitical shocks hit, any adverse impacts have tended to be limited, or in the worst case “temporary disruptions”, before markets return to underlying trends5.

1 Source: 18 June 2025, Reuters News (“Trump calls for Iran’s ‘unconditional surrender’ as Israel-Iran air war rages on”).

2 See FIV Q2 2025: Identifying opportunities in a disrupted world.

3 “Iran leader Khamenei sees his inner circle hollowed out by Israel”, 17 June 2025 Reuters News.

4 Behind Saudi Arabia (#1) and Russia (#2). Source: as at June 2025, International Energy Agency (IEA).

5 See Speedbumps in a Goldilocks environment, pages 3-4.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

The audio(s) have been generated by an AI app