Executive summary

- In 2024, returns on rates and credits will likely outpace those on cash, with a greater role for duration in portfolios.

- The inflation threat to bond investments seems to have receded.

- Record influx into money market funds could reverse, coupled with imminent rate cuts.

- EM central banks could embark on a loosening cycle post the Fed’s easing.

- As the easing cycles broadens, credit growth is anticipated to rise accompanied by a decline in the debt service burden. Easier funding conditions should mitigate distressed risks.

- Asian local currency bonds could perform well amidst a weak USD backdrop and local currency gains.

- Asian credit default rates are expected to slow in 2024. Net issuance in Asia in 2024 is expected to be negative, keeping supply constrained and technicals favourable.

- Key risks to watch in 2024 include uncertain election outcomes and the potential disruptions that could be sparked from the BoJ exiting negative rates.

2024 Fixed Income outlook (video)

2023 in recap and expectations for 2024

The year 2023 has been marked by a series of surprises, from the slowing of China’s recovery to US Treasury yields reaching 16-year highs, followed by a year-end rally alongside the Federal Reserve’s (Fed) dovish pivot. Additionally, global political tensions have heightened due to the two ongoing wars. Simultaneously, the Fed’s cash rate exceeding 5%1 has led to record inflows into money market funds, diminishing the appeal of traditional bond strategies.

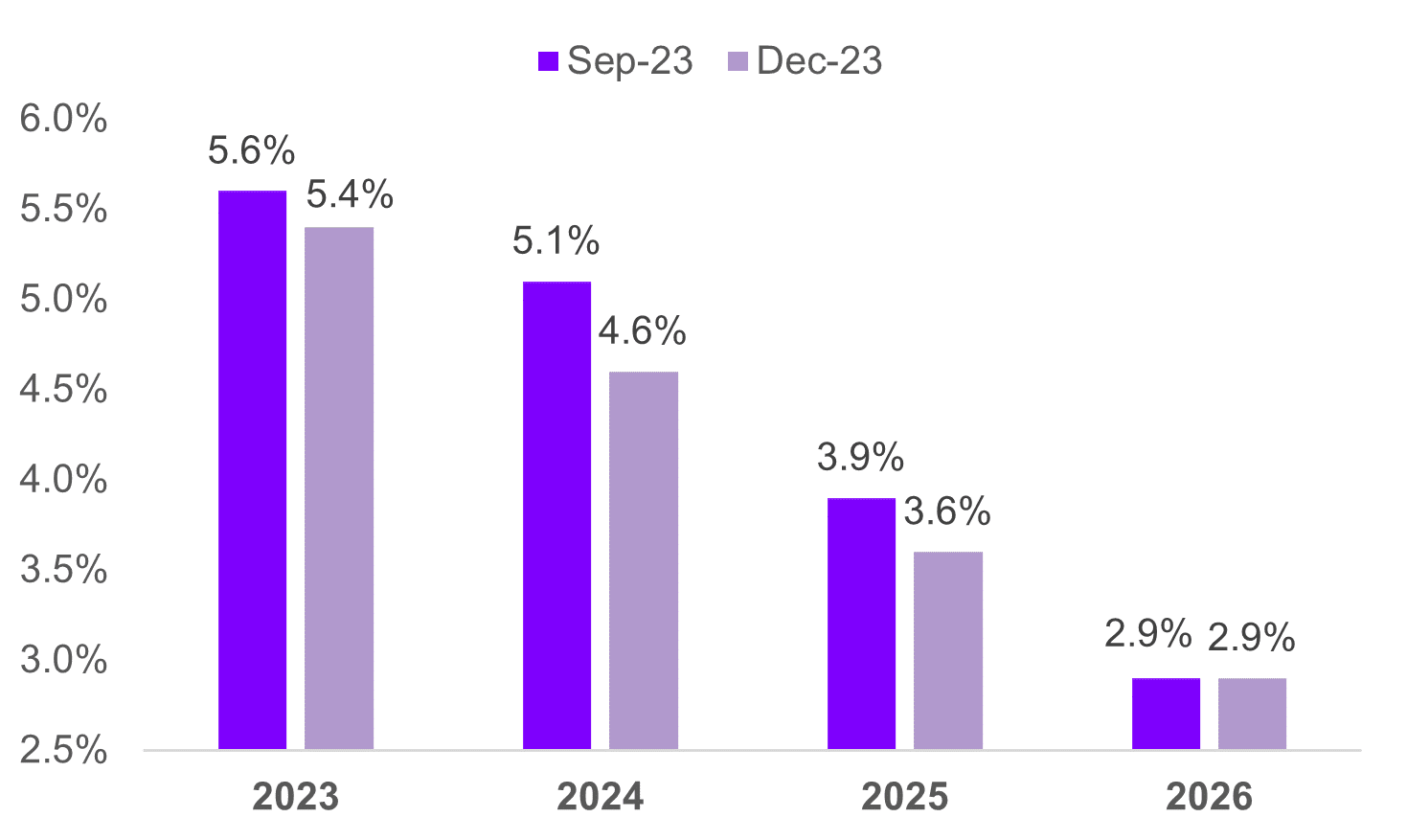

Looking forward to 2024, the global economic outlook suggests that returns on rates and credits will likely outpace those on cash, with a greater role for duration in portfolios. The once looming threat of Inflation to bond investments seems to have dissipated. Some of the record influx into money market funds could reverse, coupled with imminent rate cuts. The Fed’s dovish shift has also instilled optimism regarding a soft landing for the U.S. economy (see Figure 1). As the easing cycles broaden, credit growth is anticipated to rise accompanied by a decline in the debt service burden, propping up overall economic growth. Additionally, the easier funding conditions should mitigate distressed risks, which is conducive for the spread sectors.

Figure 1: FOMC’s Fed Funds Rate forecasts at Sep 23 and Dec 23 meetings (median values)

Source: US FOMC, JP Morgan, December 2023.

Asia local currency bonds outlook

In the Asian context, our outlook has become more optimistic for both duration and currencies. Asia appears poised for a soft landing in 2024, with inflation slowing to align with central bank targets, and growth moderating without a collapse. Falling global bond yields could lead to greater capital inflows, and an easing in oil prices has produced further disinflation. Barring unforeseen supply-side shocks, we anticipate most headline CPI figures to return to Asian central bank targets by the end of 2024 as demand-pull inflationary pressures ease. Resilience is expected from large economies like India, Indonesia, China while North Asian technology exporters, particularly Korea and Taiwan, may benefit from AI-related semiconductor demand and an inventory restocking cycle.

Easing cycles have kicked off in parts of LatAm as well as in Central and Eastern Europe (CEE) and this is set to further broaden to Asia. We expect regional central banks such as Indonesia to spearhead the rate cut cycle in the region. However, the timing of these monetary policy adjustments will depend on factors such as foreign exchange stability, geopolitical conditions, and the pace of the Fed’s easing trajectory. There is a leaning towards earlier rate cuts, given the Fed’s recent dovish pivot. Given the sharp rally in rates going into the end of 2023, we approach the addition of duration with caution. Our strategy is to capitalise on opportunities to extend duration at more favourable levels, anticipating a potential retracement in Q1 2024.

On China, we anticipate front-loaded policy support in the first half of 2024, leading to a stronger growth impulse during that period, followed by a relatively weaker growth trajectory in 2H 2024. Our expectation is that the Chinese government will aim for a GDP growth target of “around 5%2,” relying on fiscal policy as the primary driver of growth support, but we deem the probability of aggressive policy stimulus as low. Additionally, we project that monetary policy will remain largely accommodative, featuring modest easing measures such as Reserve Requirement Ratio (RRR) cuts and expected 10 basis points interest rate reductions, complementing pro-growth fiscal initiatives. With continued policy focus on the supply side suggests the domestic demand-supply imbalance may persist as a key challenge for the Chinese economy. The consequence of such imbalance has led to deflationary pressures, particularly on the consumer side, which may linger on, although 2024 CPI inflation rate is anticipated to show modest improvement, partly due to base effects.

In the realm of currencies, we anticipate the potential for USD weakness against Asian currencies in 2024. Our preference leans towards regional currencies that exhibit improving current account balances, including the Malaysian ringgit, Thai baht, and the Korean won, along with those experiencing foreign inflows, notably the Indonesian rupiah and Indian rupee. While maintaining a positive sentiment, albeit less pronounced, we project the Singapore dollar and renminbi (RMB) to conclude the year in a middle-of-the-pack position, attributed to their expensive valuations and comparatively lower yields.

Singapore bonds outlook

Likewise in Singapore, we anticipate a more favourable blend of growth and inflation in 2024. The initial half of the year is poised to experience an upswing in inflation, attributed to increases in GST, carbon taxes and other price increments including water and transportation fare. Nevertheless, a subsequent easing of inflation is probable in the latter half as the labour market undergoes a cooling phase. Turning to economic growth, Singapore’s GDP is projected to increase in 2024 relative to 2023, primarily due to a turnaround in the manufacturing sector, despite a tempering in the momentum of tourism and domestic demand stemming from the post-COVID reopening theme.

In our baseline projection, we expect the SGD NEER to hold steady throughout 2024. While earlier-than-anticipated Fed cuts could mitigate the likelihood of additional tightening measures by the Monetary Authority of Singapore (MAS) to some extent, the prospect of MAS easing remains unlikely, given the still elevated core inflation. In other aspects, Singapore Government Securities (SGS) yields are anticipated to continue tracking US Treasuries, although we forecast SGS to outperform due to more manageable supply conditions. Unlike the supply shortage experienced in the first half of 2023, the long-dated SGS supply is better distributed throughout 2024. Consequently, we anticipate the SGS yield curve to steepen and normalise during the year.

In other sectors, SGD swap spreads have exhibited a significant tightening in Q4, and we anticipate a partial retracement in Q1. Our preference remains for SGD credits over SGD statutory board bonds to enhance carry. Furthermore, we anticipate a redirection of some of the significant inflows into Monetary Authority of Singapore (MAS) bills in 2023 towards the SGD credit markets in 2024. Concurrently, the bond supply may be slow to catch up, creating a potentially favourable environment for credit investors.

Asian credit outlook

In the landscape of Asian credit in 2024, several compelling factors continue to shape opportunities. That includes expectations of a faster pace of Fed cuts will likely drive further search for yield amongst fixed income investors. The positive performance in 20233 and the still attractive carry, especially when compared to yield levels over the past two decades, are also likely to support fund flows. Some of the substantial funds directed to money markets in 2023 may shift towards credit markets. Simultaneously, the return of supply is anticipated to be gradual. Banks, eager to extend loans, combined with mostly lower local funding rates, might contribute to a delay in matching USD supply with the growing demand. The overall expectation is that net issuance across Asia will be negative in 2024, keeping technicals favourable. With primary market activity subdued, investors will need to turn to the secondary market, as demand makes a comeback.

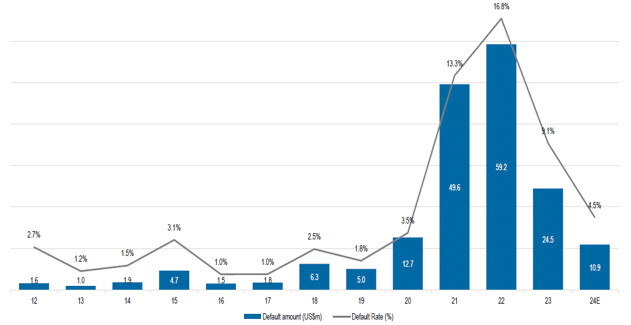

Fundamentally, most defaults in the Asian high-yield space are believed to be behind us. The default rate in 2024 is widely expected to be lower than that of 2023, reigniting risk-taking and investor confidence (see Figure 2). Strong domestic liquidity in 2023 have facilitated Asian high-yield corporations to smoothly refinance bond maturities, a trend expected to persist in the new year. Broadly, the easier funding conditions should mitigate distressed risks, creating a favourable environment for high-yield investors.

Figure 2: Asia HY defaulted amount and default rate – expected to decline further in 2024

Source: JP Morgan, December 2023

Turning to the investment-grade market, US Treasury moves are anticipated to dominate returns in 2024. The year-end rally in US Treasuries has surpassed many Wall Street predictions for the end of 2024, revealing how the “Christmas” rally has caught analysts off guard. Current swaps market pricing indicates an expectation of around 150bps4 of rate cuts in 2024, potentially starting as early as March, contrasting with the Fed’s dot plot projecting a 75bps rate cut in the same period. Similarly, we hold the view that the Christmas rally may have been overly exuberant, given our assessment that sustained declines in US Treasury yields are limited without evidence of a major slowdown in the US labour market.

Consequently, we anticipate that US Treasury yields are likely to retrace from some of the aggressive rate cut pricing, particularly as activity data is unlikely to exhibit significant deterioration in the near term. We perceive limited risk-adjusted reward in extending duration at existing levels and would look for higher yields to consider adding duration, with room for the yield curve to steepen in 2024. In this setting, our strategy is to optimise carry, particularly within the investment-grade space. We have deliberately kept some powder dry, refraining from operating at elevated risk levels in both credit and duration. In our view, there remains an opportunity to augment risk, capitalising on the active primary issuance market in Q1 2024 and the potential pullback in US Treasury yields.

Looking further into 2024, as confidence about the relative resilience of the US economy builds, the yield curve is expected to steepen. Long-end yields could rise due to the possibility of US economic resilience and concerns about US Treasury supply re-emerging. Additionally, the year is set to bring a distinct change as the Bank of Japan (BOJ) is poised to phase out its negative interest rate policy, amidst at a gradual pace. This strategic move from the BOJ is likely to exert upward pressure on US Treasury yields, adding a significant dynamic to the evolving financial landscape.

Sector-wise, going into longer duration investment-grade USD debt such as China TMT and Indonesia quasi-sovereigns may deserve a fresh look, given the imminent Fed rate cuts. We are also drawn to the BBB bloc within the investment-grade space, anticipating potential spread compression against single A in 2024. Within the financial sector, bank senior bonds appear expensive, leading us to prefer subordinated debt. Additionally, we find the valuation of Asian non-bank financials to be attractive.

We are also actively seeking diversification in Developed Asia markets such as Japan and Australia particularly in Tier 2 financials. Our interest also extends beyond Asia to non-Asian exposure, such as in the Middle East economies, notably Qatar, Saudi Arabia, UAE, though we remain mindful of the rich valuations and geopolitical risks. We also have a favourable outlook for high-yield issuers from the large economies of Indonesia and India due to robust domestic demand and favourable onshore funding conditions. The Macau gaming sector is also on our radar, benefiting from a faster-than-expected revenue recovery. However, we acknowledge the consensus and crowded nature of these trades, placing a heightened emphasis on diversification. While remaining cautious in the China high-yield real estate sector due to the disappointing housing sales and the possibility of a prolonged property downturn.

Summary

In summary, as we enter 2024, we are cautiously optimistic. We foresee a promising backdrop for returns in Asian rates and credits, given factors such as the softer stance on inflation, potential rate cuts, and the Fed’s dovish posture. Our focus on Asia underscores opportunities amid potential capital inflows and accommodative policies. In the broader Asian credit landscape, we foresee positive prospects driven by anticipated Fed cuts and a gradual return of supply.

Crucially, we maintain a watchful eye on potential risks that could reshape our outlook for 2024. On the positive side, we are closely monitoring upside risks, such as a more robust policy response from China aimed at stimulating growth, a swifter disinflationary trend surpassing the expectations of major central banks, potentially prompting earlier and more rapid rate cuts. Equally vital are the downside risks that are within our purview. These include uncertainties surrounding election outcomes, particularly the US election, and delayed effects stemming from previous rounds of aggressive (monetary) policy tightening, potentially resulting in unexpected pockets of financial stress. Another significant concern is the potential disruption to global markets as the Bank of Japan exits from negative interest rate policy.

1 The Federal Reserve raised the Fed Funds Rate to between 5.00 % – 5.25% at its May 4 2023 meeting. The Fed Funds Rate is 5.50% as at Jan 19 2024.

2 Fullerton estimates, January 2024.

3 The JPM Asian Credit index gained 7.0% (in USD terms) in 2023.

4,Source: Bloomberg, January 2024.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

All information provided herein regarding JPMorgan Chase & Co. (“JPMorgan”) index products (referred to herein as “Index” or “Indices”), is provided for informational purposes only and does not constitute, or form part of, an offer or solicitation for the purchase or sale of any financial instrument, or an official confirmation of any transaction, or a valuation or price for any product referencing the Indices (the “Product”). Nor should anything herein be construed as a recommendation to adopt any investment strategy or as legal, tax or accounting advice. All market prices, data and other information contained herein is believed to be reliable but JPMorgan does not warrant its completeness or accuracy. The information contained herein is subject to change without notice. Past performance is not indicative of future returns, which will vary. No one may reproduce or disseminate the information, whether in whole or in part, relating to the Indices contained herein without the prior written consent of JPMorgan.

J.P. Morgan Securities LLC (the “Index Sponsor”) does not sponsor, endorse or otherwise promote any Product referencing any of the Indices. The Index Sponsor makes no representation or warranty, express or implied, regarding the advisability of investing in securities or financial products generally, or in the Product particularly, or the advisability of any of the Indices to track investment opportunities in the financial markets or otherwise achieve their objective. The Index Sponsor has no obligation or liability in connection with the administration, marketing or trading of any Product. The Index Sponsor does not warrant the completeness or accuracy or any other information furnished in connection with the Index. The Index is the exclusive property of the Index Sponsor and the Index Sponsor retains all property rights therein.