Executive summary

- Asian markets’ recent drawdowns could be indicative of oversold conditions rather than fundamentally-led action.

- We continue to hold the view that growth stocks will continue to outperform value stocks, and that there are selected opportunities in the horizon.

- In the near-term we have a more favourable view on the US given its above trend growth and productivity profile.

- Over the longer-term, we have a structurally positive view on Asia due to the durability of the drivers behind some the region’s longer-term trends.

- We believe investors should remain invested and manage downside risks, so as to be positioned for potential opportunities further out when the headwinds fade.

What happened?

Asian markets saw drawdowns on Monday, 25 April following selling pressure in US markets the previous week. Reasons cited for the selloff included a hawkish Fed outlook, and concerns over China’s Covid-zero policy and its implications on growth. The interesting observation is that these triggers are not new developments, and markets selling off on “old news” typically (although not always the case), is usually indicative of oversold conditions, and technical selling, rather than fundamentally led action.

The way forward

Regardless of the near-term dislocations and whether markets are over reacting to the less sanguine headlines, we believe that investors should remain invested, and manage the downside risks accordingly, such that they may be better positioned to take advantage of potential opportunities further out, when the headwinds fade.

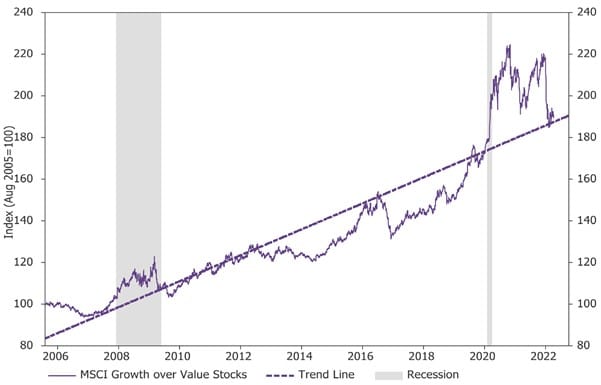

Fullerton also holds the view that the trend of growth stocks outperforming value stocks is likely to continue longer-term (even in a sustainably higher inflation environment), and there are still selective opportunities in the horizon beyond the short -term volatility.

Longer-term trend of global growth outperforming value stocks (Growth vs. Value stocks)

Source: Refinitiv Datastream, April 2022

For example, we believe that the USD is likely to appreciate, and sectors like consumer products, communications, healthcare, and renewables are well placed to hold up in the current environment.

In terms of tactical asset allocation at this point, we have a more favourable view on the US given its growth and productivity profile is above trend, and are less sanguine on Europe as the region faces headwinds from stagflation-related forces. Separately, we are cautious on Asia on the back of fluid developments in China.

Longer term however, we have a structurally positive view on Asia. There are many long-term themes and trends taking place in the region where the underlying drivers shaping the opportunity sets are enduring, and which may potentially outlast the short-termism from near-term market gyrations and volatility. Some examples include the ongoing green transition to cleaner energy. Long-term climate change considerations, and recent events in Eastern Europe if anything, highlight the need for energy independence and accelerates the need for alternative (renewable) energy sources. This is a space with firm opportunities in Asia given there are selected niche players in the region that are heavily involved in solar panel, as well Electric Vehicle (EV) battery manufacturing.

Beyond the long-term theme of green energy, there are also other industries in Asia where the incumbents are “world class” names, with high barriers to entry and best-in-class practices, which make it difficult for new entrants to replicate and take market share. For instance, in semiconductor manufacturing, Asia has many dominant leading chip manufactures in Taiwan and South Korea with high market share, strong technical know-how, and high-end manufacturing capability that is challenging for other players to copy.

In the area of business process outsourcing and consulting (which still has a long structural growth runway ahead), India has a few large global players in this space with significant scale of operations, as well as a deep and competitively priced talent pool which makes it challenging for new players to match.

In short, while there may be near-term dislocations, it is critical to remember there are still selective opportunities available, as well as longer-term structural ideas whose underpinning drivers have the potential to outlasts the short-termism of market noises and near-term volatility.