Executive summary

- There were concerns around Credit Suisse (CS) and its viability, that came to the fore just after the collapse of SVB and Signature Bank in the US.

- The triggers behind the two US bank failures, and recent volatility in CS are due to dissimilar issues.

- Furthermore, the financial stresses that CS was facing reflects different circumstances to what transpired during 2008’s Global Financial Crisis (GFC).

- CS has been having profitability issues for some time now, which were already well flagged in the public domain.

- Steps have been taken by the Swiss policymakers to stabilise the bank. The takeover of CS by UBS is seen as the most optimal solution for financial system stability.

- The recent struggles in CS is largely due to company-specific, idiosyncratic events.

- The risk of wider contagion, and systemic failure appear quite low.

What’s happening?

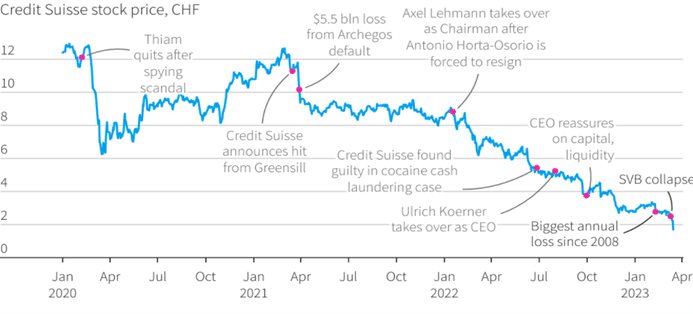

Investors’ fears surrounding the financial strength of Credit Suisse (CS) have risen since it reported its largest loss in more than a decade for 2022 and forewarned that a significant loss for this year was also likely. Resultantly, with CS share prices falling sharply (see Figure 1), and with two bank failures already in the US (SVB and Signature Bank), concerns that a significant liquidity squeeze could spark a deposit run and potentially drive CS insolvent have risen.

CS’s challenges are dissimilar to the recent two US bank failures. The latter two US banks failed due primarily to asset-liability mismatches, while CS’s struggles stems from a long-standing series of issues – scandals, leadership changes, and restructuring plans that have failed to take off. These have been well known for years.

Figure 1: Credit Suisse equity price (in CHF) and key events

Source: Refinitiv Datastream, Reuters, March 2023.

In response, on 15 March, the Swiss central bank and the financial regulator (FINMA) sought to ease fears by emphasising that CS meets capital requirements and can access liquidity. On 16 March CS announced it would take decisive action to strengthen its liquidity by borrowing up to $54bn (USD) from the Swiss Central Bank. However, by 19 March it was announced that UBS would buy-out CS, in a deal to be completed by end 2023. It now seems that such consolidation is viewed by Swiss policymakers as the most optimal solution for financial system stability.

Financial market implications

In some respects this appears like a re-run of the 2008 Lehman-driven crisis, as two US banks have failed and stress is spilling-over to Europe. However, the financial stress that CS is experiencing reflects different factors than in 2008. Back then, banks suffered from a sharp rise in loan and asset defaults, exacerbated by very weak growth, a lack of capital buffers, and limited bad debt provisions. In contrast, the financial stress today is more a reflection of selected banks struggling with high leverage and excess deposits, with liquidity being squeezed, as loan and asset growth has been insufficient.

That said, the resulting fears of bank failures and potential adverse contagion from exposures to stressed banks is certainly alarming, just as it was during the 2008 experience. However, mitigating buffers today are much greater than the past, with high bank capital adequacy and provisions for bad debts. In addition, policymakers are proving very proactive in launching initiatives to provide support to any banks in need.

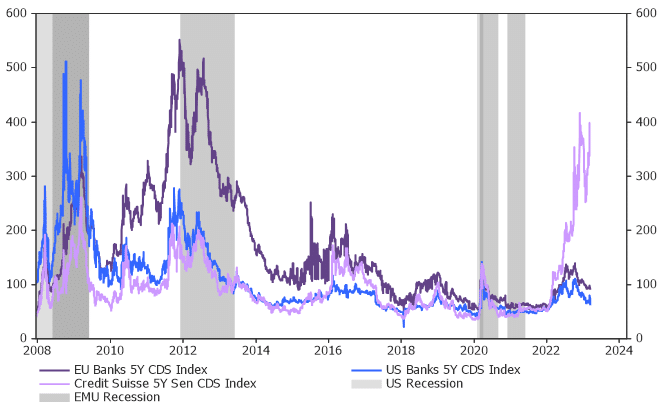

It cannot be ruled out that further stresses may emerge across some banks in Europe and in the US. But what may limit any significant financial crisis unfolding is that banking systems are fundamentally much stronger than in the past, and policymakers have a deeper experience in stabilising the investment environment when adverse financial shocks hit. So far, financial market pricing is supportive of this assessment, in that while CS’s credit-default-swap (CDS) pricing has surged, across the wider financial sector in Europe and in the US, fear of systemic failure seems contained as the CDS pricing in those regions have remained stable (see Figure 2). There is market differentiation and distinction.

Figure 2: CDS Spreads – Credit default pricing for Credit Suisse has risen, but remains stable in the broader European and US banking sector

Source: Refinitiv Datastream, March 2023.

What is encouraging so far is that the large US banks have prudently managed and reduced their exposures to CS and have judged any risks from related lending to CS as contained. It is also our view that these shocks can remain idiosyncratic and liquidity relief is expected to come as the banks most under stress receive support from policymakers, allowing them to unwind leverage and boost their income earning assets over time.

In a sign suggesting that there is still broader financial market stability and investor sentiment has not totally capitulated, the fact that there is demand from investors to acquire the assets of insolvent banks (e.g. HSBC and Goldman Sachs have indicated interest in purchasing some of SVB’s assets), is a positive signal. This is quite different to the 2008 experience where many assets across failed banks were of very poor quality. Fullerton believes that quality assets will continue to find buyers which will help foster orderly wind downs.

Conclusion

We believe the recent struggles in the two failed US banks, and Credit Suisse to be largely idiosyncratic events. The triggers behind their turmoil are quite distinct to the credit-induced US housing sector meltdown in 2008. As of now, we are of the view that the risk of wider contagion, and systemic failure appear quite low.