Executive summary

- We are in a “New World Order” concerning how governments conduct their foreign affairs.

- China, Russia, and other Latin American allies of Venezuela, have condemned the US’ actions.

- There are increased concerns on how the US may forcefully demand regime change in other jurisdictions.

- It remains to be seen if there could be escalated military action on the ground in Venezuela should the incoming President Delcy Rodríguez and her administration, prove uncooperative to the US’ demands.

- Financial markets are taking this development in its stride, as investors adjust to this new “Realpolitik” world.

- For Venezuela, what remains to be seen is how its oil infrastructure and investments to its energy sector will play out under presumed US influence, and how it may look to restructure its sovereign debt over time.

- Having a diversified portfolio with active management is a prudent way to navigate evolving markets.

- Any ill effects from geopolitical shocks are expected to be short-lived. We continue to have a 12-month bullish view on global risk assets, with a positive outlook for fixed income.

What happened?

In what has proved the most significant US intervention in Latin America since the December 1989 invasion of Panama, US Special Forces landed on 3 Jan 2026 in Caracas and captured President Nicolas Maduro and his wife Cilia Flores. They are now on trial in a Manhattan court charged with sending drugs to the US and narco-terrorism. President Trump has declared that the US will ‘run’ Venezuela for now and that US oil companies will eventually ‘take over’ the oil industry’1.

Developments that have further added to this spike in geopolitical fears are:

• The US has threatened further military interventions if Venezuela’s Interim President Delcy Rodriguez does not appease the US2.

• The UN Security Council will debate the legality and implications of the US seizure of a foreign head of state. China, Russia, and other Latin American allies of Venezuela, have condemned the US for violating international law3.

• Concerns have increased that the US could forcefully demand regime changes in other jurisdictions.

The latter fear requires passage of time for clarity, and if realised, could ultimately prove the more impactful – especially if countries like China push-back to the US. The key signposts to watch, for potential investment stress, remain the volatility across risk-asset prices.

Implications

So far global investors are taking developments in stride, as equities climbed (across Asia, Europe, and US futures), gold prices increased, and bond yields generally held4. In part this could reflect hope that Venezuela can achieve stability under a US-approved government, with more investment in the oil industry and infrastructure, and a potential sovereign debt restructuring in time.

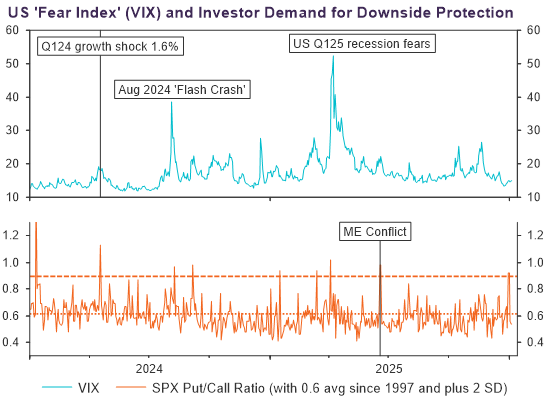

US credibility is extremely critical, and perhaps not surprisingly then, global market reactions are similar to the June 2025 Middle East conflict5. It is Fullerton’s view that investors are adapting to this ‘realpolitik world’6. The best way to navigate geopolitical stresses is with active management of a diversified portfolio (where holdings of gold are especially useful) and to seek downside protection when risks hit (see Figure 1).

Risk appetite is proving well-behaved and investors are not overly concerned as seen by the sanguine reaction in the S&P 500 ‘fear index” (the VIX) and the lack of cross-asset volatility – even in crude oil prices (see Figure 2).

Figure 1: The VIX ‘Fear Index’ (top panel) has remained low (at 15)

US investors demanded more downside protection into year-end (with a 2 standard deviation jump)

Source: LSEG Datastream, 6 Jan 2026.

Figure 2: Volatility impacts across key markets and asset classes:

Volatility is very muted and most volatility metrics are still below the last 12mth averages

Source: LSEG Datastream, 6 Jan 2026.

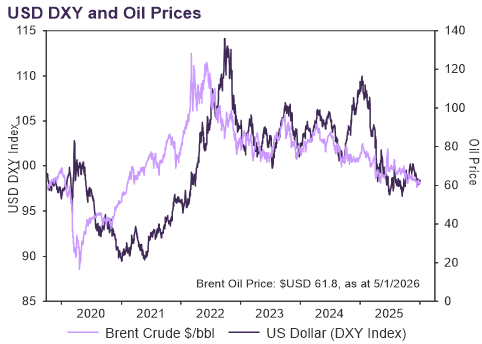

Venezuela has more proven oil reserves than any other country, but poor output, while the US is a significant net oil exporter7. Oil prices have not moved materially and remain locked with the US dollar (see Figure 3). Given the importance of US net oil exports, any longer-term shifts in the flexibility of oil supply may be discounted by the market as oil prices are already low.

Figure 3: Oil and the US dollar have stayed subdued

Source: LSEG Datastream, 6 Jan 2026.

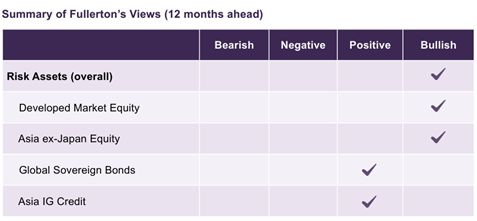

Fullerton has shown evidence before that when geopolitical shocks hit, any adverse impacts can be limited, or in the worst case ‘temporary disruptions’, before markets return to underlying trends8. Fullerton maintains its bullish outlook on global risk assets as presented in the Q4 2025 Fullerton Investment Views9.

For the next 12 months, Fullerton is bullish on global risk assets, driven by Asia and Developed Market equities, with a positive outlook for fixed income returns

Source: Fullerton Investment Views Q4 2025. Investment views and portfolio positioning are subject to change without prior notice.

1 Source: The Financial Times (FT) Newsletter, 6 Jan 2026.

2 Source: Reuters 4 Jan 2026.

3 Source: Reuters 5 Jan 2026.

4 Source: Reuters 5 Jan 2026.

5 See Middle East Conflict – Fullerton Fund Management

6 See Investing in a Realpolitik world

7 Source: The Financial Times Newsletter (6 Jan 2026) and Reuters (5 Jan 2026).

8 See Fullerton Investment Views Q4 2023 ‘Speedbumps in a Goldilocks Environment’ pp4

9 See Fullerton Investment Views Q4 2025 ‘Goldilocks and the Risk Appetite Bear’

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

The audio(s) have been generated by an AI app