Executive summary

- This marks the first US government shutdown in close to 7 years, and the third under a Trump administration. The episode was driven by partisan gridlock rather than any pressing fundamental funding shortfall.

- There may be a short-term spike in unemployment claims, as federal agencies face furloughs or layoffs, but with limited long-term economic impact.

- Investor reaction has been muted – US equities have held steady, treasury yields eased, the USD slipped, while gold rose.

- Pressure from the American public to resolve this impasse quickly will build, although the length of this shutdown is unknown.

- US fundamental strength remains intact. There is no basis to adjust our constructive outlook on US risk assets and the credit markets.

What happened?

The US government shut down much of its operations on Wednesday 1 October, after divisions across Congress and the White House derailed any budget agreement continuing Federal funding. The heart of the disagreement is that selected healthcare tax credits are due to expire for Americans in 3 months, and the Democrats want the financial supports extended while the Republicans are generally opposed.

This is the 15th US government shutdown since 19811, and although it is always difficult to predict its duration, it does have the potential to last an extended period, as happened in 2018-19 (35 days) and 2013 (16 days). This shutdown may differ from previous events given that the Office of Management and Budget (OMB) has suggested Federal agencies consider terminating some “non-essential” employees instead of furloughing them. On the other hand, this is a shutdown that is driven entirely by brinkmanship rather than a lack of monies for the government to function. Pressure from the American public will build on both Republicans and Democrats alike to resolve the impasse as quickly as possible.

Implications

With the shutdown, certain non-essential functions of government will temporarily cease. This can include certain sections of the US’ national parks, monuments, and museums; as well as government data collection and reports2. Selected governmental agencies will go into furlough, with some federal workers not being paid. Essential activities like the military, air traffic control and law enforcement will continue. Moreover, mandatory spending such as Social Security and Medicare are not disrupted. In addition, the US Treasury’s debt auctions and interest payments continue.

With disruptions to Federal government services, there could be a short-term spike in unemployment claims. In addition, such political brinkmanship can erode investor confidence if it lasts too long. However, this time around other elements of US fiscal policy are providing significant financial support to US firms, to encourage spending on R&D and capital goods3 – which in turn, will provide cushion to any material drag on economic activity. Not surprisingly, all previous shutdowns have had little impact on GDP growth because government funding and services are restored long before the quarter ends4.

Market reaction and impact ahead

Investors’ response thus far has been relatively muted, perhaps because this shutdown was well-telegraphed as likely, and because it is not a reflection of a lack of money to function – it is a political problem of “the will”’ not “the means”. Nevertheless, such political brinkmanship can create some risk-off sentiment – longer-end US treasury yields slipped along with the US dollar, while gold prices can rally. That said, we expect fundamentals including corporate earnings, labour market conditions, inflation trends, and the Fed’s policy path to re-assert themselves once official funding is restored. We remain constructive on US duration, with front-end yields anchored by easing expectations, while the long end may face steepening pressure as policy uncertainties lift term premia. Credit markets should stay well-supported on the back of strong demand for yield and manageable supply, with low volatility and the lack of major negative catalysts sustaining a carry-driven environment.

Likewise, the equity market appreciates that the government shutdown is unsustainable and may rebound as favourable fundamentals are not at risk. In the past, it has often been the case that stocks quickly recover even as the politicians may still be trying to reach a compromise.

Consistent with US government shutdowns lacking any material economic impact over the longer term, stocks are generally higher three months after the government re-opens. On this basis there are no developments that lead us to adjust our bullish outlook for risk assets as presented in our Q3 2025 Fullerton Investment View5.

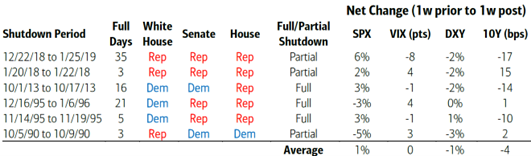

Figure 1: Previous US government shutdowns have had small impact on volatility and risk assets

Source: Bloomberg and BofA Global Research 25 Sep 2025. The shutdown can be partial if some appropriation bills have been passed, or agencies have been funded, or complete/full if no bills have been passed. From 1 Oct 2025 it is a full shutdown.

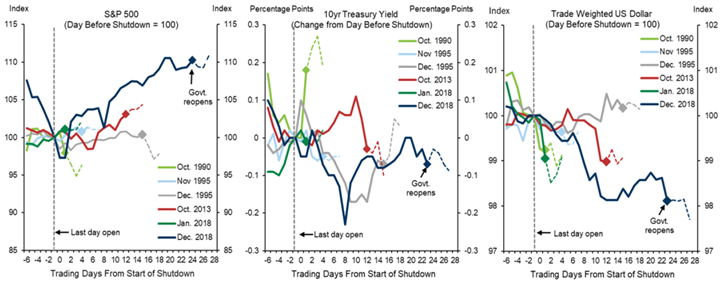

Figure 2: US S&P500, US 10y Yield, and US dollar impact paths from previous US government shutdowns

Source: Goldman Sachs Global Investment Research 28 Sep 2025.

1 Source: Reuters News 1 Oct 2025.

2 Note that data produced by the Fed will not be disrupted because it is not impacted. In addition, privately produced data (i.e. ISM, University of Michigan consumer sentiment etc) would also be reported as usual.

3 Under the One Big Beautiful Bill Act (OBBBA, 4 July 2025).

4 For example, US GDP growth remained positive during all 5 of the government shutdowns since 1995 (source: LSEG Oct 2025).

5 See Investing in a Realpolitik world – Fullerton Fund Management

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

The audio(s) have been generated by an AI app