Like your favourite kopi, Fullerton SGD Heritage Funds are designed for every appetite for income

Robust blends of underlying assets that provide monthly payouts1 and potential capital appreciation

Introducing the Fullerton SGD Heritage Series

Investing is like enjoying kopi—there is one for every palate and climate.

The Fullerton SGD Heritage Series is crafted to meet your appetite for retirement income, regardless of market conditions. Designed by an award-winning1 Singaporean investment team, our robust funds are designed to bring you monthly payouts2 and potential capital appreciation over the long run.

Why invest in the Fullerton SGD Heritage Series?

The fund series seeks to provide for your investment needs at life’s different stages, may it be to grow your capital for wealth accumulation, achieve a kau (“intense”) cash payout for retirement income, or somewhere in between. The Funds are conceptualised with the following considerations:

SGD currency

SGD-based solution that Singaporeans are more comfortable with

Yield

Ability to provide regular yield to support an active retirement lifestyle

Singapore properties

Quality real estate in land-scarce Singapore that generates steady rental yield

Capital gains

Some capital upside over time to build asset base and hedge against inflation

Fullerton SGD Heritage Income

Just like how Kopi Kau Kau packs quite a punch, this fund delivers thick monthly payouts to boost your income.

Strategic Asset Allocation

For investors who favour income and downside risk protection. This fund invests in bonds and S-REITs to deliver an increased fixed payout of 5% p.a. or 8.8% p.a. S-REITs also offer limited potential capital appreciation.

For fund details, refer to the factsheet and product highlight sheet.

(Please also refer to the prospectus below.)

Note: We have discretion to perform tactical asset allocation and vary the percentage of the NAV of this fund that is exposed to the various underlying instruments, including the percentage allocated to the stated assets. The fund may also invest in developed market equities (ex-Asia) for diversification reason.

Fullerton SGD Heritage Balanced

Similar to the smooth and flavourful Kopi Kau, you can enjoy both monthly payouts and potential capital appreciation with this well-balanced fund.

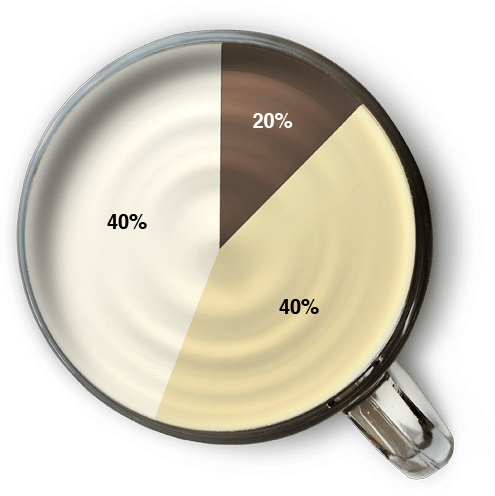

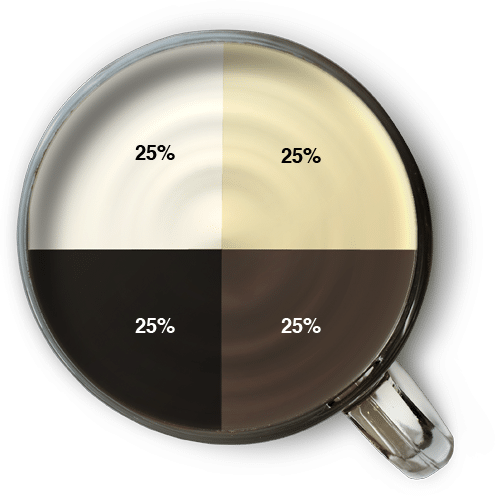

Strategic Asset Allocation

For investors who are looking for a proportionate blend of income and capital appreciation. This fund invests evenly in bonds and equities (including S-REITs). Historically, bonds have offered income and stability during market downturns. Equities and S-REITs provide potential capital appreciation and yield respectively.

For fund details, refer to the factsheet and product highlight sheet.

(Please also refer to the prospectus below.)

Fullerton SGD Heritage Growth

Like the rounded and mellow Kopi, this fund lets you savour potential capital appreciation with a taste of monthly income.

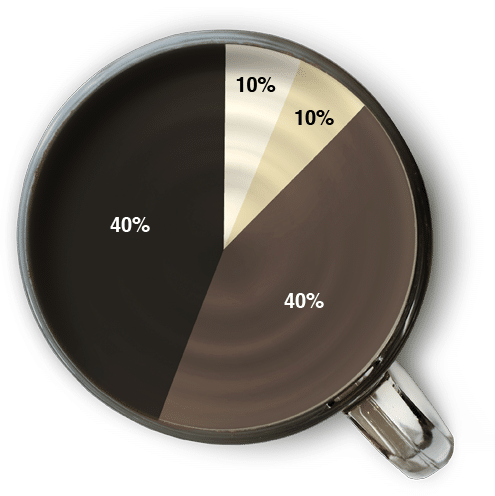

Strategic Asset Allocation

For investors who favour capital appreciation over income and can ride out short to mid-term market volatility. This fund invests primarily in equities and S-REITs for potential capital appreciation, supplemented with some income from S-REITs and bonds.

For fund details, refer to the factsheet and product highlight sheet.

(Please also refer to the prospectus below.)

Ready to discuss your retirement plans?

Standard Chartered Securities (B) Sdn Bhd is our exclusive distributor of the Fullerton SGD Heritage Series in Brunei. Please reach out to Standard Chartered Bank for further enquiries.

Contact your licensed Relationship Managers or Wealth Consultants at Standard Chartered Securities Gadong or Kuala Belait branches

For in-depth detail, refer to the fund prospectus.

1 Please refer to our website for full listing of the awards. Past performance of the Manager is not indicative of future performance.

2 For distributing units.

Disclaimer

Fullerton Fund Management Company Ltd. (UEN. 200312672W) (“Fullerton”) does not have a capital market service licence under the Securities Market Order 2013 to provide investment advice to clients, or to undertake investment business, in Brunei. Information contained in this document should not be construed as legal, regulatory, financial, investment, tax or accounting advice. It does not constitute an offer or solicitation of securities for sale by Fullerton in Brunei Darussalam. Securities referred to herein may not be offered or sold in Brunei Darussalam except by an appointed licensed distributor in Brunei and these securities are registered/recognised under the Securities Market Order 2013 or are exempt from such registration. No money, securities or other consideration is being solicited by Fullerton, and, if sent in response to the information contained herein, will not be accepted by Fullerton.

The value of units in the fund and any accruing income for the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton, except for fixed distribution payout, and are not guaranteed. The fixed distribution rate may not reflect the rate of return on your investments. Distribution may be declared out of income and/or capital of the fund, in accordance with the offering documents. Distribution out of capital may result in a partial return of your original investment and reduced future returns. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the fund.

Prior to investing in any fund managed by Fullerton, prospective investors should read the latest offering documentation carefully, including but not limited to the relevant fund’s prospectus which contains (among other things) a comprehensive disclosure of applicable risks. The offering documents (including the prospectus) are available free of charge at the office of the appointed licensed distributor, Standard Chartered Securities (B) Sdn Bhd. This document does not constitute an offer or an advertisement within the meaning of the Securities Market Order 2013 and shall not be distributed or circulated to any person in Brunei other than the intended recipient.

Exclusively distributed by: