The Fund in a nutshell: hear from our fixed income team

About the Fund

Established two decades ago, Fullerton Short Term Interest Rate Fund ("FSTIR") was designed to achieve medium-term capital appreciation for investors seeking short-dated, quality bonds. It invests in a carefully curated mix of short-dated, high-quality SGD-denominated credits, and foreign currency-denominated credits (fully hedged to SGD^^), with no specific industry or sectoral emphasis. This strategic approach seeks to ensure consistency while minimising currency risk, making it a viable choice for those seeking stability and steady returns.

Why now?

Global central banks pivoting to rate cuts makes bonds potentially more attractive compared to cash-like products, as cash rates are expected to decline. For your investments to continue working hard, consider allocating to FSTIR, to optimise your cash without significant quality compromise.

Experienced team, established and proven track record across market cycles

The core team has successfully navigated several major market events, such as the Global Financial Crisis, 2013’s taper tantrum, and Covid, while maintaining a focus on capital preservation and measured growth.

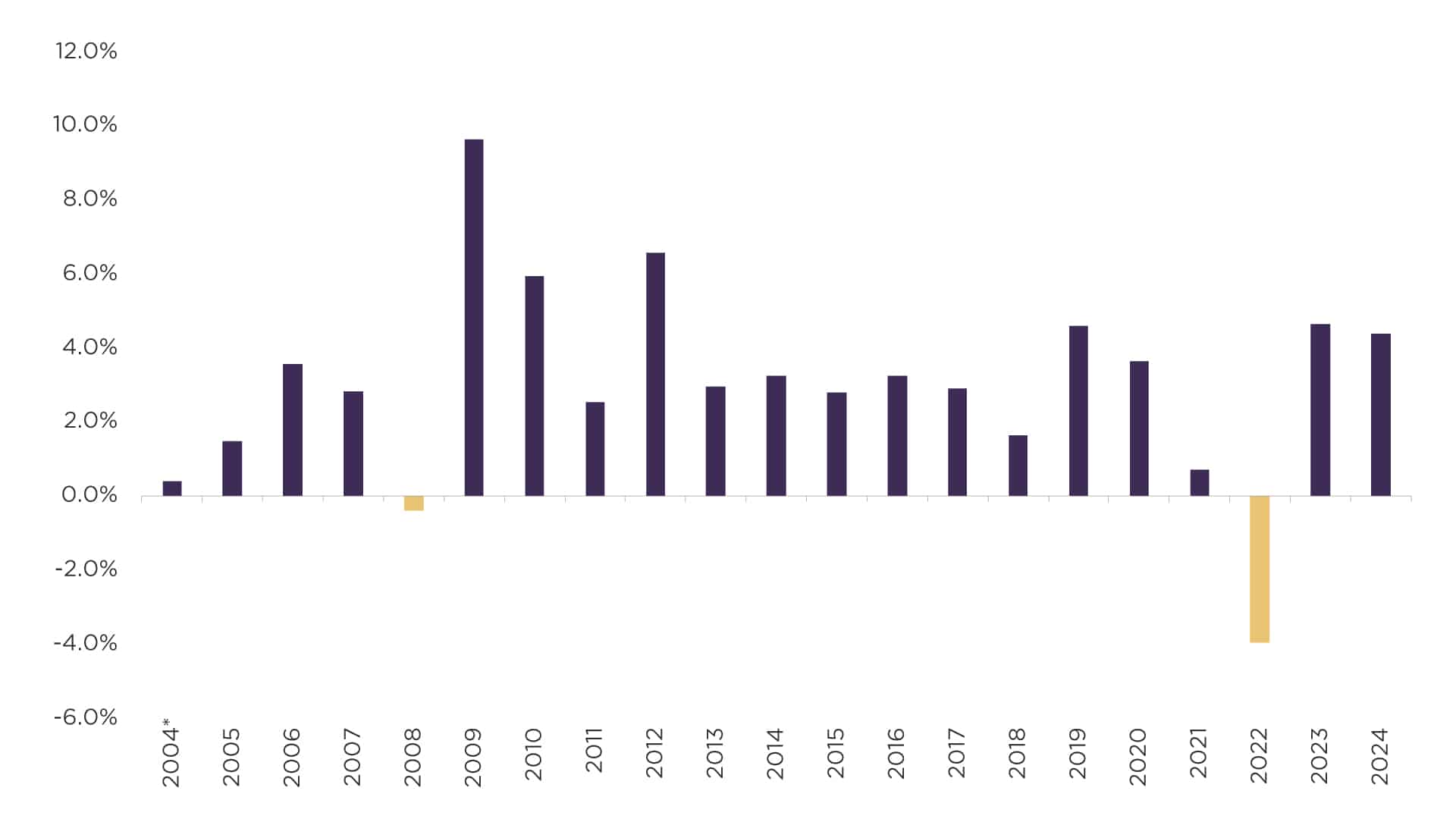

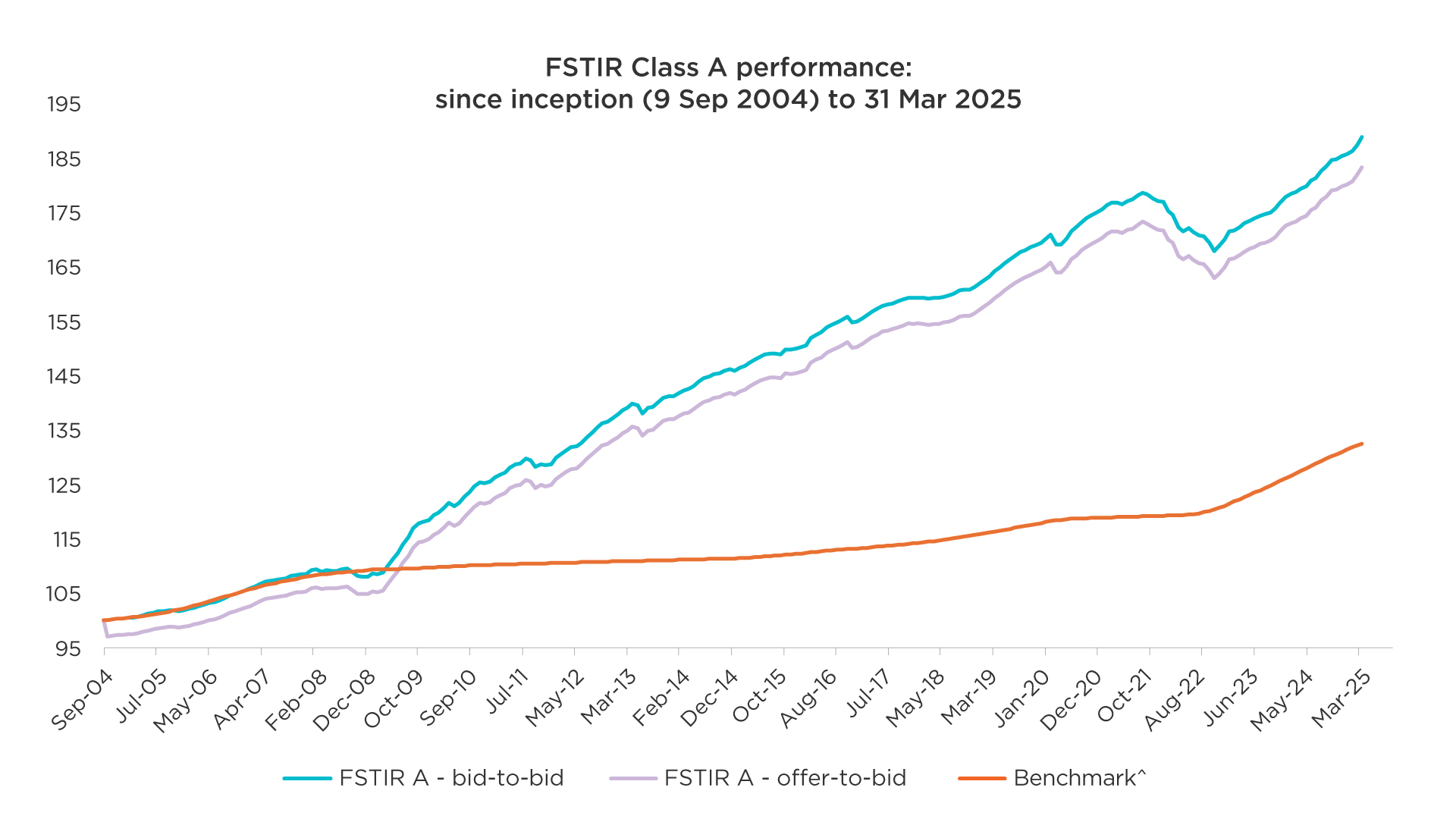

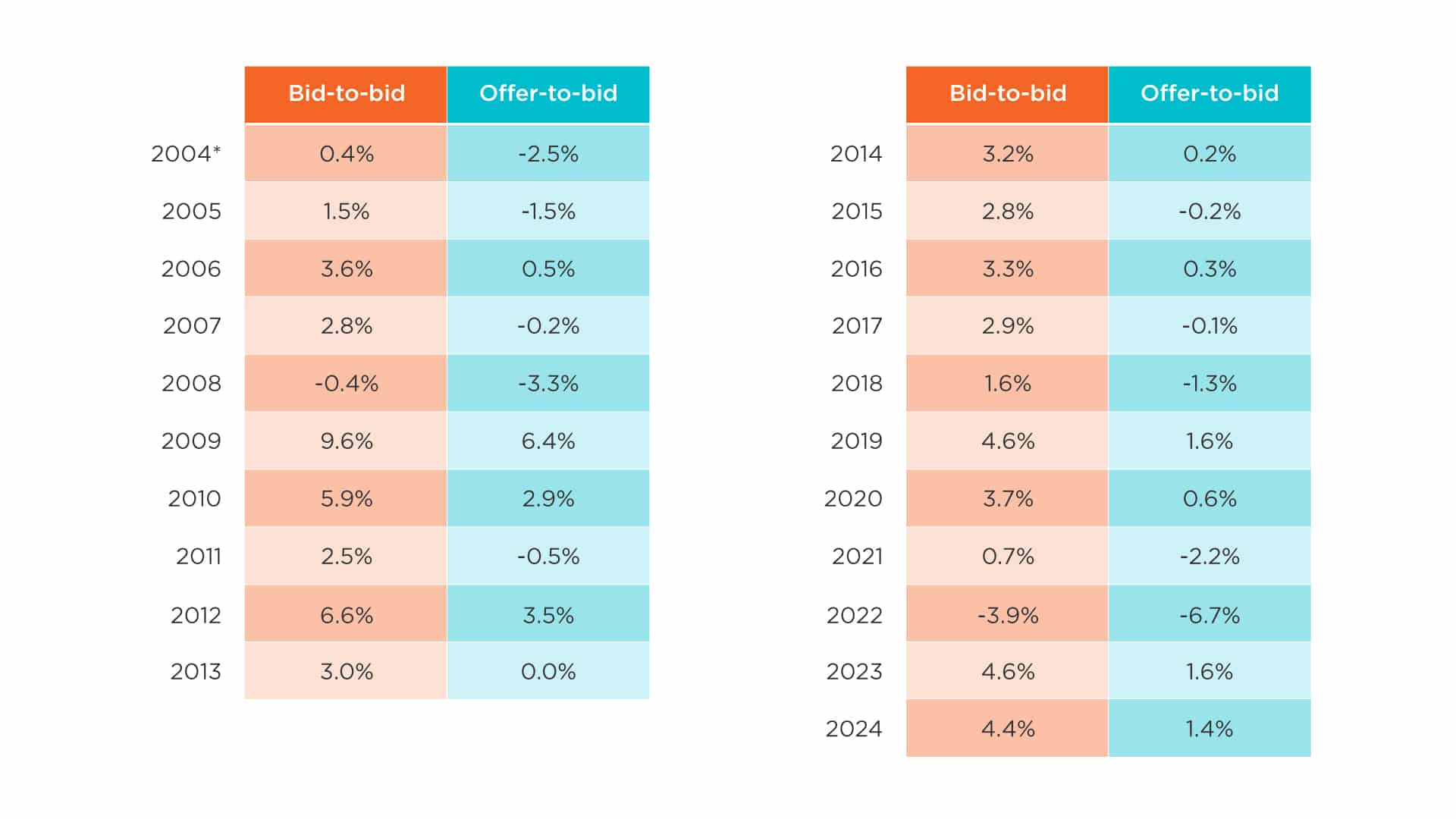

The Fund has a proven, 21-year track record, even during challenging conditions, with 19 out of 21 positive calendar year returns (bid-to-bid) since its inception in September 2004 (class A share class).

FSTIR Class A performance: calendar year bid-to-bid returns since inception (9 Sep 2004)

FSTIR Class A performance: calendar year bid-to-bid and offer-to-bid returns since inception (9 Sep 2004)

Fullerton Short Term Interest Rate Fund

For more information, please speak to our distributors

^^ Except for a 5% frictional currency limit to account for possible deviations from a 100% hedge.

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.