Re-globalisation of trade in a Realpolitik world, is reshaping the opportunity sets across global risk assets.

China equities are on a sustained uptrend. Supportive policies, solid earnings, fair valuations, and rising liquidity are the driving forces.

Asian fixed income is steadily gaining recognition as one of the few asset classes where both structural evolution and cyclical dynamics are reshaping the outlook for returns, diversification, and policy flexibility.

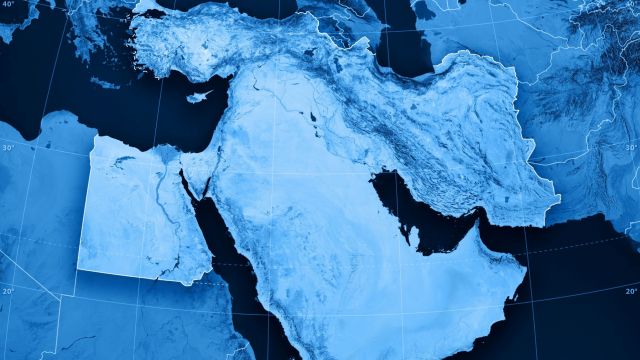

Iran-Israel conflict thus far confined to oil markets. Risk appetite well-behaved. Near-term impact from geopolitical shocks tend to be transient.

There are (still) alpha opportunities to extract against a volatile backdrop from Trump’s “Reciprocal Tariffs”