Building a Stronger Portfolio with Singapore Income Funds

With T-bill yields falling and market volatility back, many Singapore-based investors are asking: what should I do with my cash?

If your daily spending and savings are in Singapore Dollars (SGD), it may make sense to grow your portfolio in the same currency.

In this week’s edition, we explore three SGD-denominated bond funds managed by Fullerton Fund Management. Each fund offers different levels of income, risk, and flexibility. Whether you are managing idle cash or planning for long-term income, there may be something here for you.

Why SGD-denominated funds?

The Singapore Dollar (SGD) is typically perceived by investors as a safe haven currency. Singapore’s AAA sovereign credit rating, strong reserves, and managed exchange rate system have supported confidence in the currency over time.

As a Singapore-based investor, holding assets in SGD means your investments are aligned with your spending and liabilities. This helps you avoid the cost and uncertainty of currency conversion.

All three Fullerton funds are SGD-denominated. They hedge non-SGD exposures back to SGD, subject to a 5 percent frictional currency limit. This reduces the impact of exchange rate movements on your investment.

#1 – Fullerton Short Term Interest Rate Fund – For capital stability and medium-term growth

The Fullerton Short Term Interest Rate Fund is designed to achieve medium-term capital appreciation for investors seeking short-dated, quality bonds.

As of 31 October 2025, about 27 percent of the portfolio is exposed to Singapore, with the rest diversified across Asia and selected global markets. Foreign currency bonds are fully hedged back to SGD, except for a 5 percent frictional currency limit.

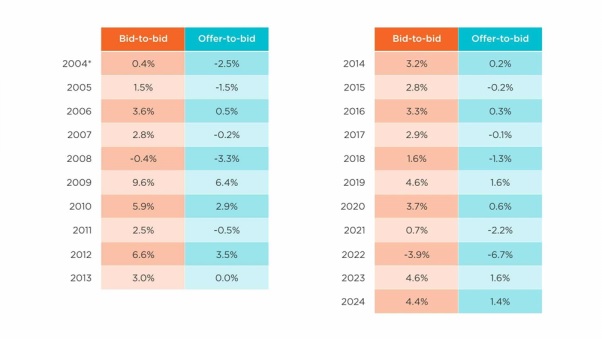

FSTIR Class A performance: calendar year bid-to-bid and offer-to-bid returns since inception (9 Sep 2004)

Source: Fullerton Fund Management. Returns are calculated on a single pricing basis in SGD with net dividends and distributions (If any) reinvested. Offer-to-bid returns include an assumed preliminary charge of 3% which may or may not be charged to investors. Past performance is not necessarily indicative of future performance. *Performance period was from 9 Sep 2004 to 31 Dec 2004.

All bonds are investment grade, which means that they have credit ratings of at least BBB- by Standard and Poor’s or Baa3 by Moody’s (or their respective equivalents). Around 71.5 percent are rated BBB as of 31 October 2025.

Over the past year, the Fullerton Short Term Interest Rate Fund Class A returned 5.44 percent bid-to-bid, outperforming its benchmark (3M SORA + 0.60% p.a.) which returned 2.96 percent as of 31 October 2025.

The Fullerton Short Term Interest Rate Fund Class A has also delivered positive calendar year net returns in 19 out of the past 21 years since its inception in September 2004 (Class A share class). Class C1 offers a quarterly distribution.1

1Quarterly distribution at the fund manager’s absolute discretion, which may be declared out of income and/or capital and is not guaranteed. You may refer to Fullerton’s website for details on historical payouts.

#2 – Fullerton SGD Savers Fund – For enhanced cash management

The Fullerton SGD Savers Fund is designed for investors who seek to balance between liquidity and yield, while targeting a higher return than SGD fixed deposit rate.

Launched in 2023, the fund invests in SGD fixed deposits, short-term government bonds, and investment-grade corporate credits. It may also hold some foreign currency bonds, which are fully hedged to SGD, except for a 5 percent frictional currency buffer.

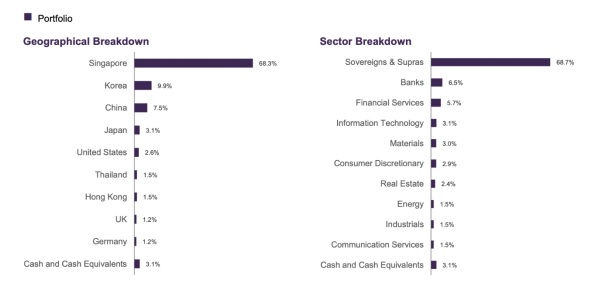

As of 31 October 2025, the fund held 34 positions. Most of these are MAS Bills and Singapore Treasury Bills. The portfolio is 68.3 percent allocated to Singapore, 68.7 percent to sovereign and supranational issuers, and 67.1 percent rated AAA.

Source: Fullerton SGD Savers Fund – Class A Factsheet as of 31 October 2025

The Fullerton SGD Savers Fund – Class A returned 2.63 percent bid-to-bid and 2.12 percent offer-to-bid over the past year, compared to the benchmark (3-month SORA Compounded Average + 0.50 percent per annum) return of 2.86 percent. For those seeking regular income, Class A2 offers a quarterly distribution.1

1Quarterly distribution at the fund manager’s absolute discretion, which may be declared out of income and/or capital and is not guaranteed. You may refer to Fullerton’s website for details on historical payouts.

#3 – Fullerton SGD Income Fund – For long-term income and diversification

The Fullerton SGD Income Fund is designed for investors seeking regular income or long-term capital appreciation in SGD terms. It invests in a globally diversified credit portfolio, with a flexible mix of investment-grade and high-yield bonds.

The fund can invest up to 30 percent in high-yield bonds.2 As of 31 October 2025, about 20 percent of the portfolio was in high yield, and 62 percent was rated BBB. It also invests in foreign currency bonds, which are fully hedged to SGD, except for a 5 percent frictional currency limit.

The fund holds around 210 bonds as of 31 October 2025. About 19 percent of the portfolio is in Singapore, with the rest spread across Asia, Europe, and other regions as of 31 October 2025. Most holdings are in corporate bonds, with minimal exposure to sovereign or supranational debt.

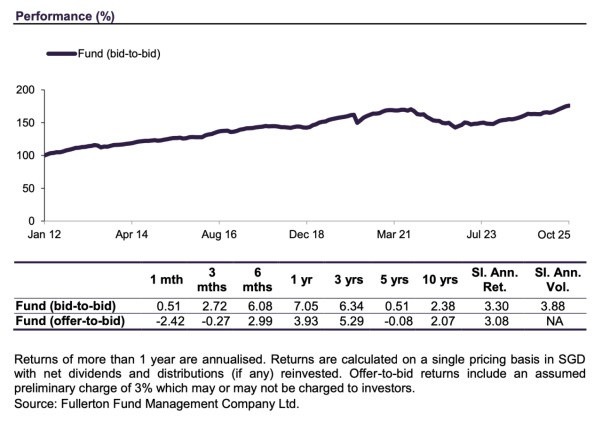

Source: Fullerton SGD Income Fund Share Class A Factsheet 31 October 2025

The Fullerton SGD Income Fund Share Class A returned 7.05 percent bid-to-bid over the past year, as of 31 October 2025. Class A offers a quarterly distribution.1

2Bonds with a long-term credit rating of less than BBB- by Standard & Poor’s, Baa3 by Moody’s, or BBB- by Fitch (or their respective equivalents).

1Quarterly distribution for the Fullerton SGD Income Fund Share Class A is at the fund manager’s absolute discretion, which may be declared out of income and/or capital and is not guaranteed. You may refer to Fullerton’s website for details on historical payouts.

Risks and considerations

- Not capital guaranteed – Bond funds can fluctuate in value, and there’s no guarantee you’ll get back your original investment.

- Interest rate risk – Bond prices tend to fall when interest rates rise. The longer the fund’s duration, the more sensitive it is.

- Credit risk – Corporate bonds carry default risk. Fullerton actively manages this through internal credit assessments.

- Currency risk – While the funds hedge non-SGD exposures, a 5% frictional limit applies.

Refer to the respective fund prospectus for the full list of risk disclosures.

Final thoughts

Fullerton offer a suite of income funds for those looking to strengthen the SGD core of their portfolios.

These income funds offer options across the risk-return spectrum, from cash enhancement to income generation and long-term diversification.

With interest rates falling and volatility rising, SGD-denominated bond funds provide a simple, currency-aligned way to stay invested and earn income.

Find out more about these funds on the Fullerton website

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.