After a year of high interest rates, the tide is starting to turn.

Singapore’s T-bill yields have declined since the start of 2025. As of 28 August 2025, the cut-off yield on the 6-month Singapore T-bill was at 1.44%.

And now, with US Federal Reserve officials projecting interest rate cuts by the end of 2025, we may be entering a new phase of the interest rate cycle.

This raises a timely question: how do bond funds typically perform when rates are falling?

Let us investigate as we prepare for a potential shift in interest rate policy.

How do bond funds typically perform when rates decline?

To address this question, let’s look at how bond prices work.

When interest rates fall, the value of existing bonds with higher fixed interest payouts tends to rise. This is because newer bonds in the market offer lower yields, making older ones more attractive.

Bond funds, which hold a portfolio of such bonds, may benefit in two key ways:

- Price appreciation – As rates fall, bond prices typically go up. This can lead to potential capital gains within the fund.

- Steady income – Bonds bought when yields were higher can continue generating attractive income, even if new bonds offer less.

Put simply, bond funds can offer potentially both income and growth when yields start moving lower.

Why this matters now

Based on the projections released by US Federal Reserve officials in June 2025, a majority expect at least two 25 basis point rate cuts by the end of the year.

As interest rates decline:

- New bond yields may drop

- But bond funds that already hold higher-yielding bonds can benefit from both income stability and potential capital gains

How Fullerton’s bond strategies are positioned

Fullerton Fund Management offers a suite of bond funds designed for different income and risk profiles. Each is actively managed to navigate changing interest rate environments.

Fullerton Short-Term Interest Rate Fund (FSTIR)

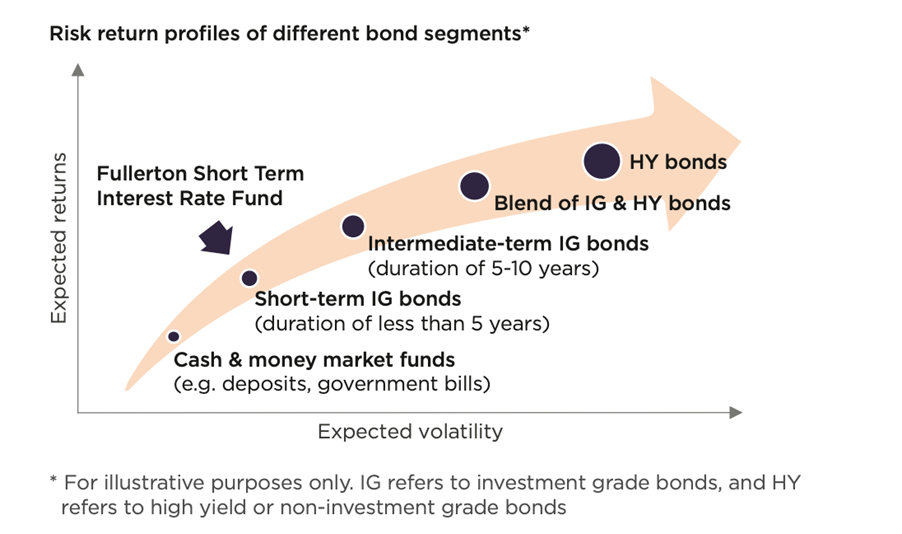

The Fullerton Short Term Interest Rate Fund potentially presents a more compelling solution for those looking to enhance returns beyond cash holdings should cash yields decline.

The Fund seeks to deliver stable returns by investing in high-quality, short-dated corporate bonds, providing low-risk investors with a balanced approach to performance and safety.

Source: Fullerton Fund Management

Fullerton Lux Funds – Flexible Credit Income

The Fullerton Lux Funds – Flexible Credit Income is designed to achieve long-term capital appreciation by adopting a multi-pronged approach by allocating across different types of bonds.

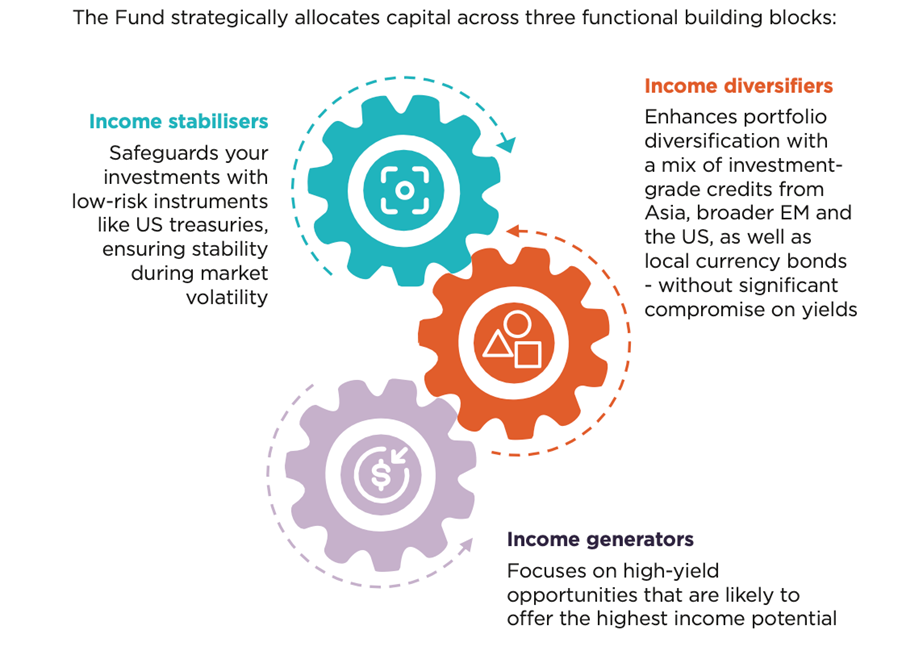

The Fund strategically allocates capital across three functional building blocks:

- Income stabilisers: Safeguards your investments with low-risk instruments like US treasuries, ensuring stability during market volatility

- Income diversifiers: Enhances portfolio diversification with a mix of investment- grade credits from Asia, broader EM and the US, as well as local currency bonds – without significant compromise on yields

- Income generators: Focuses on high-yield opportunities that are likely to offer the highest income potential

Source: Fullerton Fund Management

What to watch for

Of course, bond funds are not without risk. Your principal is not guaranteed, and the value of your investment may fluctuate with market conditions.

That said, the impact of rate changes varies depending on the type of fund:

- Shorter-duration bond funds tend to have less price volatility

- Actively managed portfolios can respond to opportunities as the rate environment shifts

- Diversified holdings across issuers, sectors, and regions can help reduce concentration risk

As always, it’s important to align your investment choices with your risk tolerance, time horizon, and income needs.

Navigating interest rate fluctuations

As interest rates move lower and cash yields become less attractive, bond funds offer a way to stay invested, generate passive income, and manage risk.

Explore Fullerton’s bond strategies: https://www.fullertonfund.com/investment-funds/featured-funds/

Important information

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.