When investing in a bond fund, it’s natural to focus on the potential returns and income.

However, understanding how risks are managed is just as important, especially in a volatile market.

This week, we take a closer look at the Fullerton Lux Funds – Flexible Credit Income, and how its structure is designed to generate long term capital appreciation for investors.

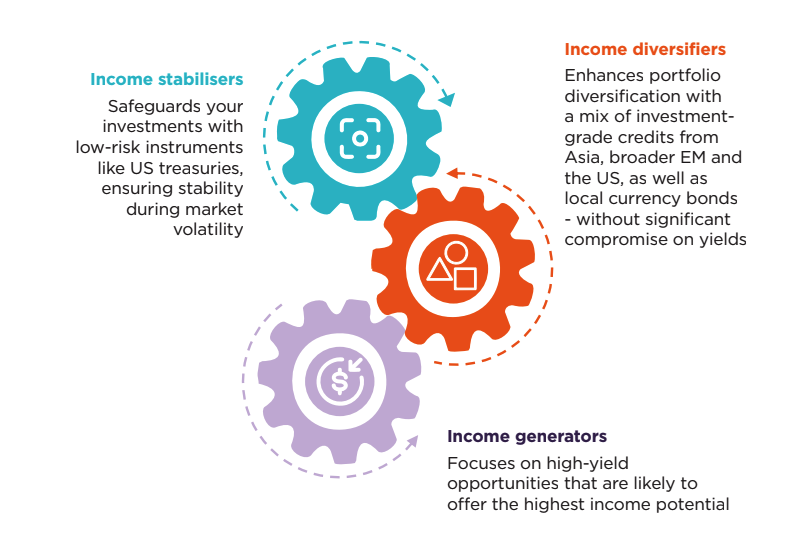

How the fund manages risk through diversification

The Fullerton Lux Funds – Flexible Credit Income adopts a multi-pronged approach by allocating across different types of bonds.

This helps to create a portfolio that is designed to achieve long-term capital appreciation.

Here’s how the fund is structured:

Income stabilisers

Low-risk instruments such as US Treasuries act as a cushion during market volatility, offering stability to the portfolio.

US Treasuries are loans made to the US government, which is seen as one of the most reliable borrowers in the world. Because of this, they are considered low risk.

While they may not offer high returns, they typically bring stability when markets are uncertain.

Income diversifiers

These include a mix of investment-grade bonds from Asia, the US, and emerging markets, including local currency bonds.

Investment-grade bonds are loans made to governments or companies that have a strong credit quality.

These borrowers are seen as less likely to default, which means they are expected to pay back what they owe, along with regular interest.

By lending to a mix of governments and companies in various parts of the world, the fund is not overly dependent on any single country. As a result, it seeks to broaden geographical exposure without significantly sacrificing potential yield.

Income generators

These are higher-yielding credit opportunities that aim to enhance overall income potential.

This combination allows the fund to stay nimble in different market conditions to earn higher potential returns while managing downside risk.

A team-based investment approach

The fund is managed by a multi-specialist team, with each portfolio manager contributing their own area of expertise.

This structure enables more informed and balanced investment decisions, drawing from diverse insights across credit markets.

Regular distributions payout and competitive performance

The fund seeks to maintain regular distributions1 to support your regular cash flow needs.

Whether you reinvest or use it for day-to-day expenses, the fund is designed to optimise income and generate long term capital appreciation.

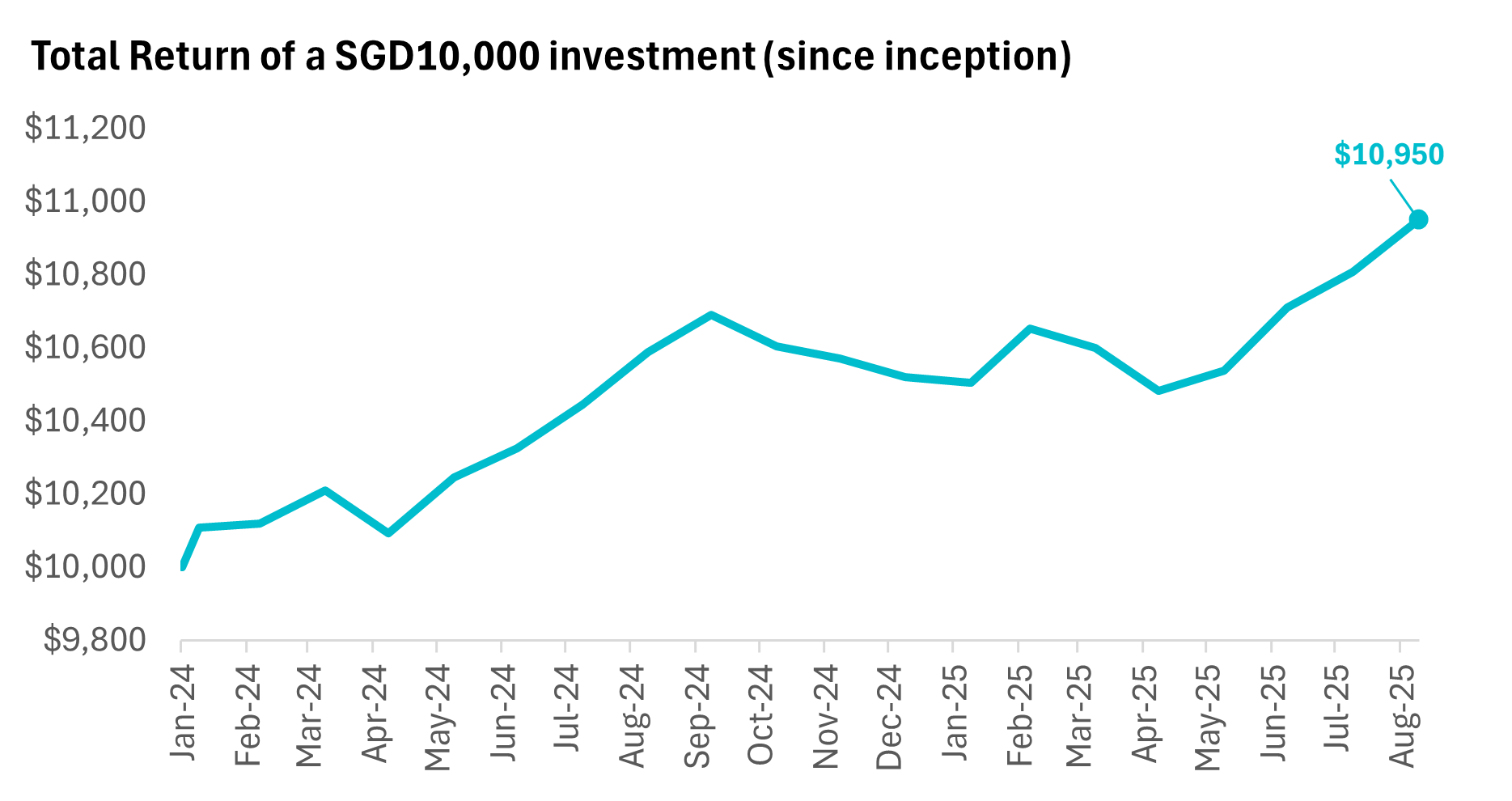

If you had invested SGD10,000 in the fund’s Class A (SGD-H) Distribution share class at inception and reinvested all payouts, your investment would have grown to SGD10,950 as at the end of August 20252.

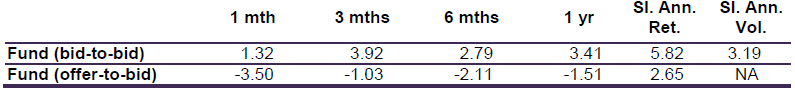

Class A (SGD-H) Dist performance (%)3

1Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus

2 Source: Fullerton, Bloomberg, as of 31 August 2025. Based on bid-bid returns, net of fees and with dividends reinvested.

3 Source: Fullerton as of 31 August 2025. Returns of more than 1 year are annualised. Returns are calculated on a single pricing basis in SGD with net dividends and distributions (if any) reinvested. Offer-to-bid returns include an assumed preliminary charge of 5% which may or may not be charged to investors. Past performance is not indicative of future returns.

Managing risk in bond investing: 3 quick tips

- Diversify across credit quality and regions to lower concentration risk

- Stay invested – time in the market reduces the impact of short-term fluctuations

- Review your investment goals and risk appetite regularly

In uncertain markets, being patient and disciplined can make all the difference. And as we like to remind investors – time in the market is more important than timing the market.

*Please refer to the Fund’s prospectus for the full list of risk disclosures of the Fund

Important information

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.