Positioning for Global Opportunities with USD Income Funds

If you’re looking to diversify your portfolio or meet spending needs in US dollars (USD), USD-denominated income funds could offer a compelling opportunity.

We explore three USD bond funds managed by Fullerton Fund Management, each offering different levels of income, flexibility, and credit exposure.

Whether you’re seeking capital stability, diversified income, or higher potential returns from credit opportunities, there may be something here for you.

Why USD-denominated funds?

USD-denominated bond funds tend to offer higher yields than Singapore dollar (SGD) funds.

For investors with USD-based needs, such as overseas expenses, liabilities, or investments, USD income funds can help avoid the cost and uncertainty of currency conversion.

They also give investors access to a broader universe of global and regional issuers, across sectors and credit ratings, enabling more ways to optimise returns and manage risk.

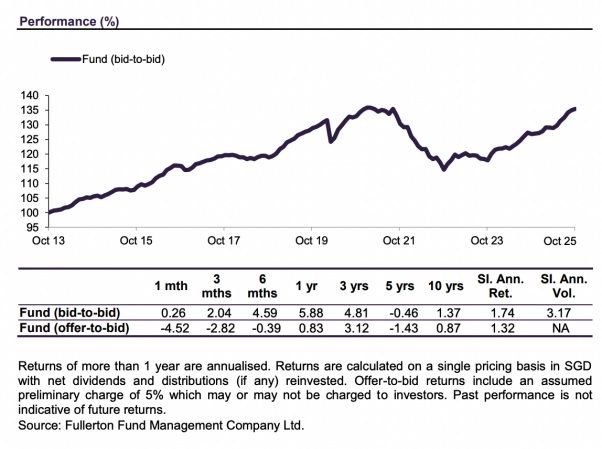

#1 – Fullerton Lux Funds – Asian Short Duration Bonds

This fund invests mainly in short-term, USD-denominated bonds issued by companies and governments in Asia. It may also invest in local currency bonds selectively.

The Fullerton Lux Funds – Asian Short Duration Bonds focuses on high-quality credits and keeps duration short to reduce sensitivity to rate movements. As of 31 October 2025, the average duration was at 2.6 years.

By targeting short-dated securities, the Fullerton Lux Funds – Asian Short Duration Bonds seeks to generate long term capital appreciation and/or income returns for investors.

The Fullerton Lux Funds – Asian Short Duration Bonds – Class A (SGD Hedged) Dist generated a 1-year return of 5.88 percent (bid-to-bid) as of 31 October 2025.

Distributions are intended quarterly, but remain at the manager’s discretion1.

1Any past payout yields and payments are not indicative of future payout yields and payments. Distributions are not guaranteed and may be declared out of income and/ or capital. You may refer to fullerton’s website for details on historical payouts.

Source: Fullerton Lux Funds – Asian Short Duration Bonds – Class A (SGD Hedged) Dist Factsheet 31 October 2025

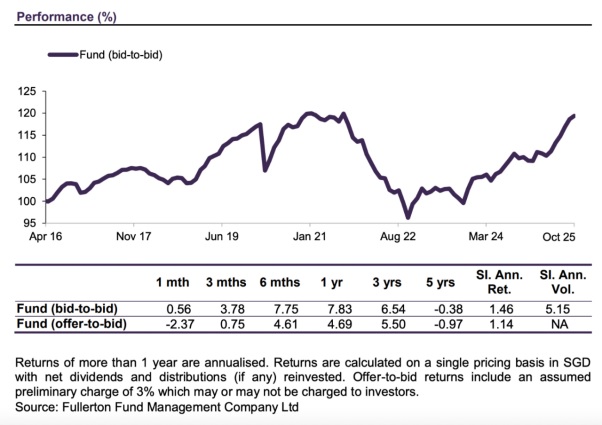

#2 – Fullerton USD Income Fund

The Fullerton USD Income Fund aims to deliver long-term capital appreciation and income by investing in a broad mix of USD-denominated bonds.

The fund will invest in a diversified portfolio of primarily investment grade fixed income securities having a minimum long term credit rating of BBB by Fitch, Baa3 by Moody’s or BBB by Standard & Poor’s (or their respective equivalents) and cash.

The fund may also invest in non investment grade bonds of up to 30% of its Net Asset Value. Non-investment grade bonds are bonds with credit ratings of less than BBB- by Standard & Poor’s, Baa3 by Moody’s or BBB- by Fitch (or their respective equivalents).

As of 31 October 2025, the average credit rating of the fund is BBB.

Geographically, the fund is diversified across Asia, the Middle East, and developed markets. Top country exposures include Hong Kong (14.8%), China (14.3%), Saudi Arabia (11.6%), and the UAE (11.4%) as of 31 October 2025.

From a sector perspective, banks (29.5%), real estate (19.9%), and consumer discretionary (10.1%) make up the largest exposures as of 31 October 2025.

The Fullerton USD Income Fund – Class A (SGD Hedged) generated a 1-year return of 7.83 percent (bid-to-bid) as of 31 October 2025.

Source: Fullerton USD Income Fund – Class A (SGD Hedged) Factsheet 31 October 2025

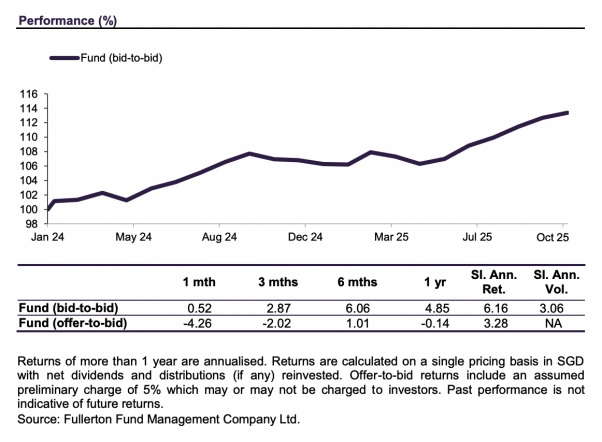

#3 – Fullerton Lux Funds – Flexible Credit Income

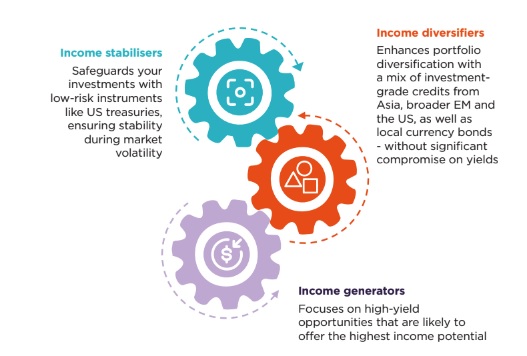

The Fullerton Lux Funds – Flexible Credit Income is designed to achieve long-term capital appreciation by adopting a multi-pronged approach by allocating across different types of bonds.

The Fund strategically allocates capital across three functional building blocks:

- Income stabilisers: Safeguards your investments with low-risk instruments like US treasuries, ensuring stability during market volatility

- Income diversifiers: Enhances portfolio diversification with a mix of investment- grade credits from Asia, broader Emerging Market (EM) and the US, as well as local currency bonds – without significant compromise on yields

- Income generators: Focuses on high-yield opportunities that are likely to offer the highest income potential

The fund seeks to maintain regular distributions1 to support your regular cash flow needs.

Whether you reinvest or use it for day-to-day expenses, the fund is designed to optimise income and generate long term capital appreciation.

The fund generated a 1-year return of 4.85 percent (bid-to-bid) as of 31 October 2025.

Source: Fullerton Lux Funds – Flexible Credit Income Class A (SGD-H) Dist Factsheet 31 October 2025

1Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. You may refer to Fullerton’s website for details on historical payouts.

Key risks and considerations

These funds are not capital guaranteed. Investors should be aware of several risks:

- Interest rate risk – Bond prices may decline if interest rates rise. Funds with longer duration are more sensitive.

- Credit risk – Bonds may be downgraded or default. This is especially relevant for funds with high-yield exposure.

- Currency risk – If you invest in USD funds using SGD, fluctuations in exchange rates can affect returns. Fullerton offers both USD and SGD-hedged share classes for flexibility.

Always refer to the respective fund prospectus for full risk disclosures before investing.

Final thoughts

Fullerton’s suite of USD income funds offers a range of options depending on your investment goals.

From the lower price volatility of short-duration Asian bonds to the diversification of global income and the potential upside of credit-focused strategies, you can choose what suits your needs.

If you’re looking to diversify your portfolio, meet USD-denominated expenses, or enhance potential returns through global bond exposure, these funds can provide a way to stay invested and earn income as market conditions evolve.

Find out more about these funds on the Fullerton website

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore