Why staying invested matters more than timing the market

It’s tempting to react to the latest news headlines or social media buzz when making investment decisions. After all, who doesn’t want to buy low and sell high?

But the reality is that consistently timing the market is extremely difficult, even for the most seasoned investors. More often than not, trying to jump in and out at the “right time” can backfire.

That’s why one timeless principle still holds true — time in the market is more important than timing the market.

How staying invested can make a difference

When you stay invested over time, you give your investments the opportunity to ride through market fluctuations and benefit from the power of compounding. It also helps reduce the urge to react emotionally to short-term volatility.

Let’s look at an example using the Fullerton Flexible Credit Income Fund.

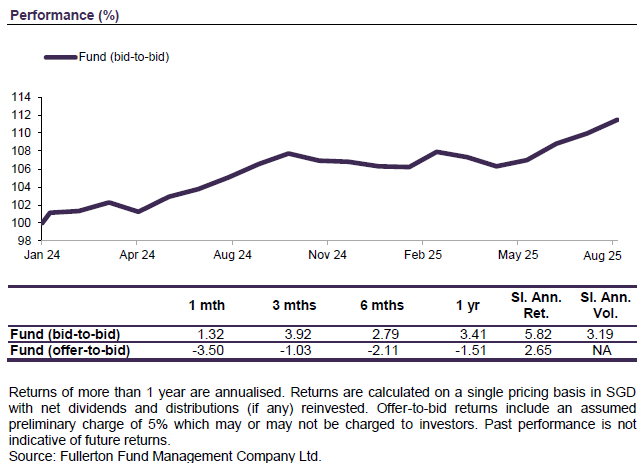

By analysing the fund’s performance across different holding periods, we found that the fund has a 1-year return of 3.41% (bid-to-bid) as of 31 August 2025, even though there were periods of negative returns within this period.

Performance of Fullerton Lux Funds – Flexible Credit Income – Class A (SGD Hedged) Dist

By staying invested over a longer period, investors are better positioned to ride out short-term market fluctuations. In such cases, patience and consistency tend to matter more than trying to time the market.

Understanding the Fullerton Flexible Credit Income Fund

The Fullerton Flexible Credit Income Fund is designed for investors seeking long-term capital appreciation through a flexible income-focused approach. It combines different types of bonds to create a balanced and diversified portfolio:

● Income stabilisers: Low-risk assets such as US Treasuries provide stability during volatile periods

● Income diversifiers: Investment-grade bonds from Asia, the US and emerging markets help broaden the portfolio without compromising yields

● Income generators: Higher-yielding opportunities aim to enhance overall income potential

The fund also offers monthly interest distributions*, which can support regular cash flow needs — whether you’re reinvesting or using it for daily expenses.

Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus.

Three tips to stay disciplined

Investing can feel uncertain at times, but a few simple steps can help you stay on track:

● Have a clear investment plan that aligns with your goals and risk tolerance

● Stick to your plan even when markets get volatile

● Avoid letting emotions dictate your investment decisions

In the long run, time in the market — not timing the market — is what often makes the biggest difference.

Disclaimer

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.