Since the start of 2025, the US dollar has faced significant volatility.

As of July 11, the Dollar Index, which tracks the USD against a basket of major currencies, has fallen by 9.8% year-to-date, its steepest decline in five years, according to Bloomberg data.

For Singapore-based investors, this has naturally led to one question: What are some SGD-denominated investments available to us?

The Singapore Dollar (SGD) is widely seen as one of the most stable currencies in Asia, supported by Singapore’s strong fiscal reserves, disciplined monetary policy, and AAA credit rating (Source: Fitch Ratings as of 10 April 2025).

For Singapore-based investors with US-centric portfolios, SGD-denominated funds can offer an added layer of diversification, helping to potentially:

- Reduce currency risk

- Reduce FX drag on returns

- Align investment income with local spending and liabilities

Exploring your SGD-denominated options

There are four SGD-denominated funds from Fullerton Fund Management that investors can tap on.

Here’s a quick summary of each fund:

1. Fullerton Short-Term Interest Rate Fund

This fund aims to achieve medium-term capital appreciation for investors. The fund is broadly diversified with no specific industry or sectoral emphasis.

The fund invests in a curated mix of short-dated government and investment-grade corporate bonds, with maturities of up to five years.

Foreign currency bonds are hedged to the SGD^.

^Except for a 5% frictional currency limit to account for possible deviations from a 100% hedge

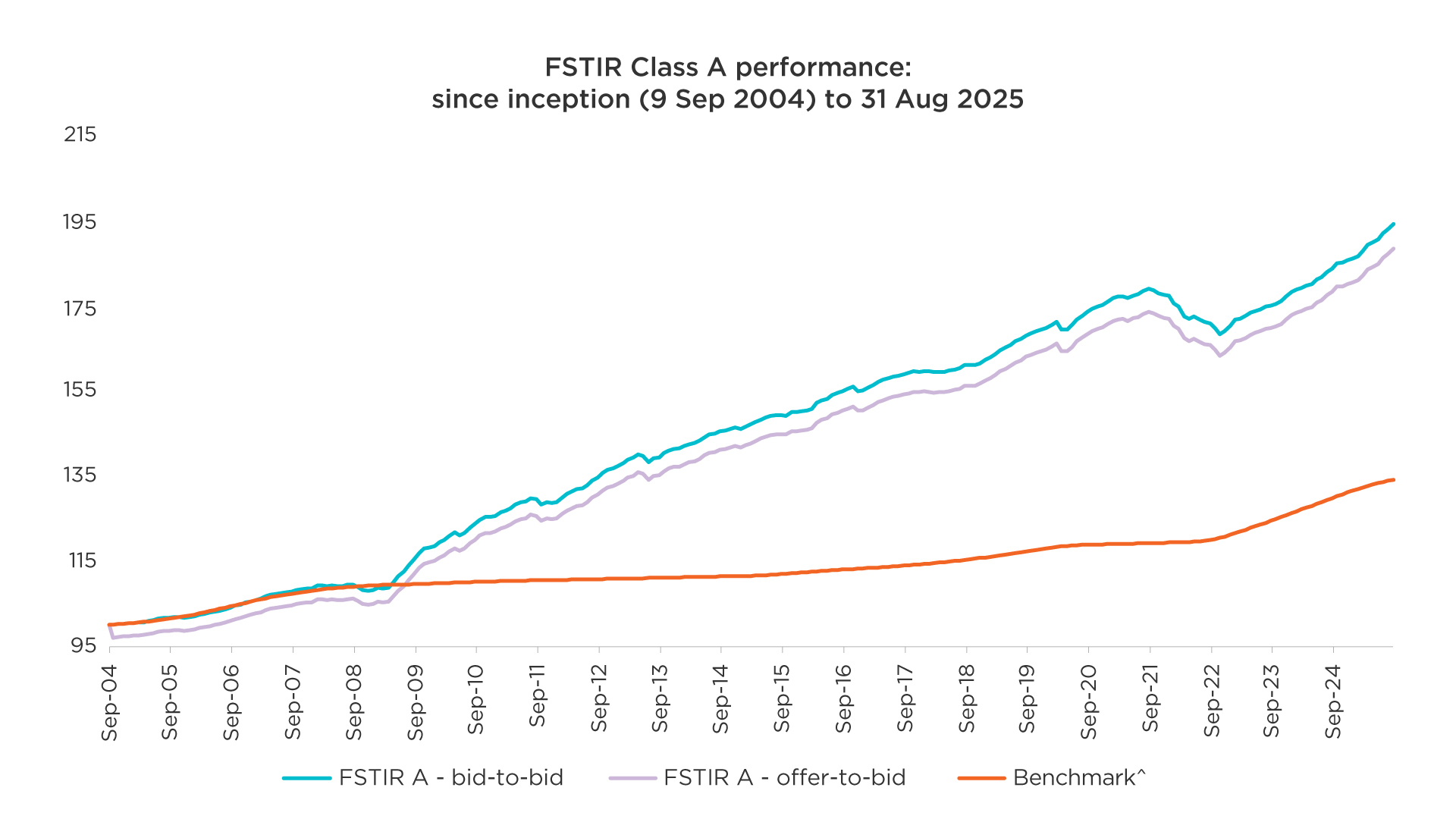

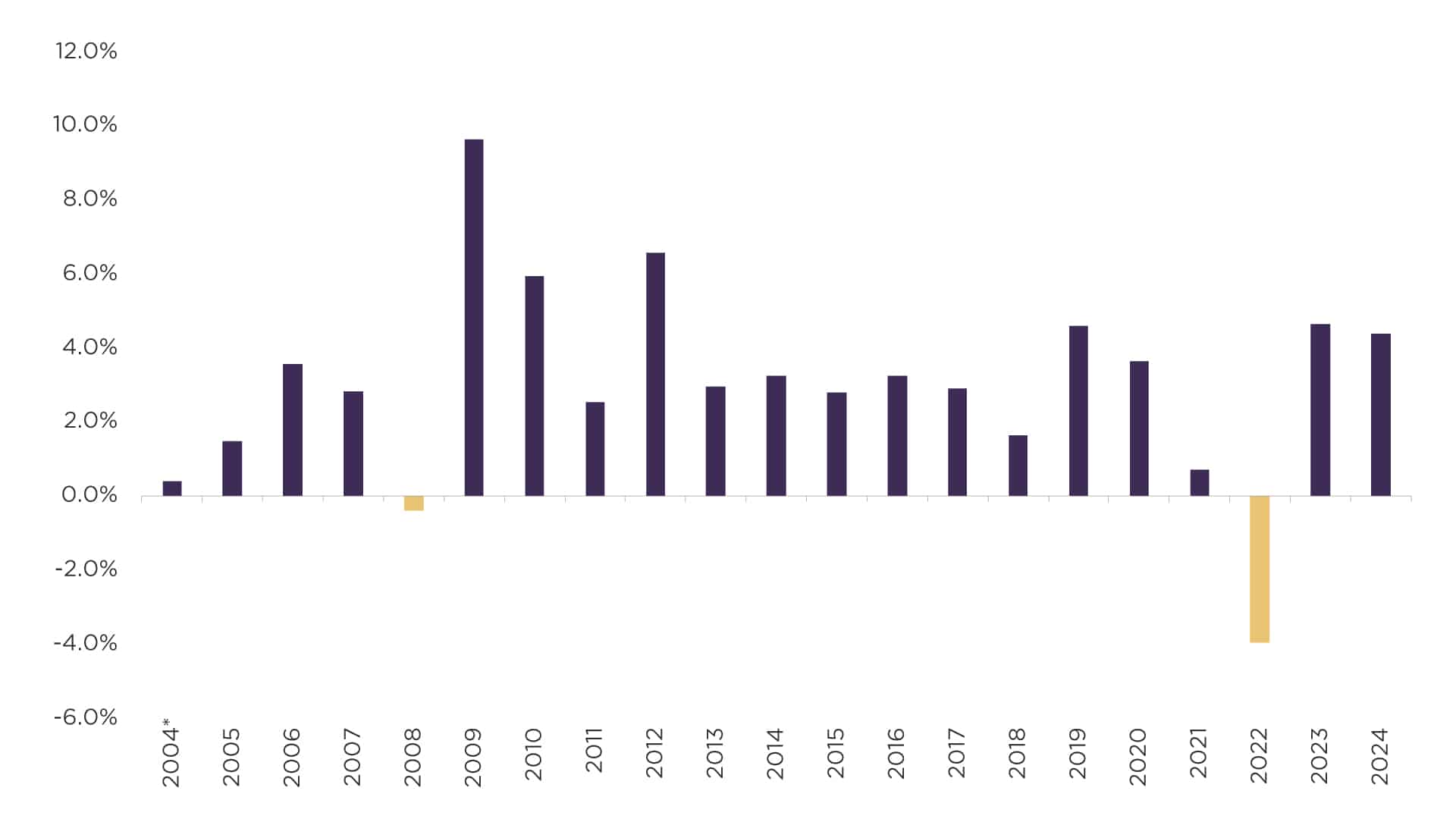

The fund has also consistently delivered positive calendar year net returns in 19 out of the past 21 calendar years since its inception in September 2004 (class A share class).

Source: Fullerton Fund Management. Returns are calculated on a single pricing basis in SGD with net dividends and distributions (If any) reinvested. Offer-to-bid returns include an assumed preliminary charge of 3% which may or may not be charged to investors. Past performance is not necessarily indicative of future performance. ^From 1 Aug 2023, the benchmark is 3M SORA + 0.60% p.a. From inception till 31 July 2023, the benchmark was 3M SIBID.

FSTIR Class A performance: calendar year bid-to-bid returns since inception (9 Sep 2004)

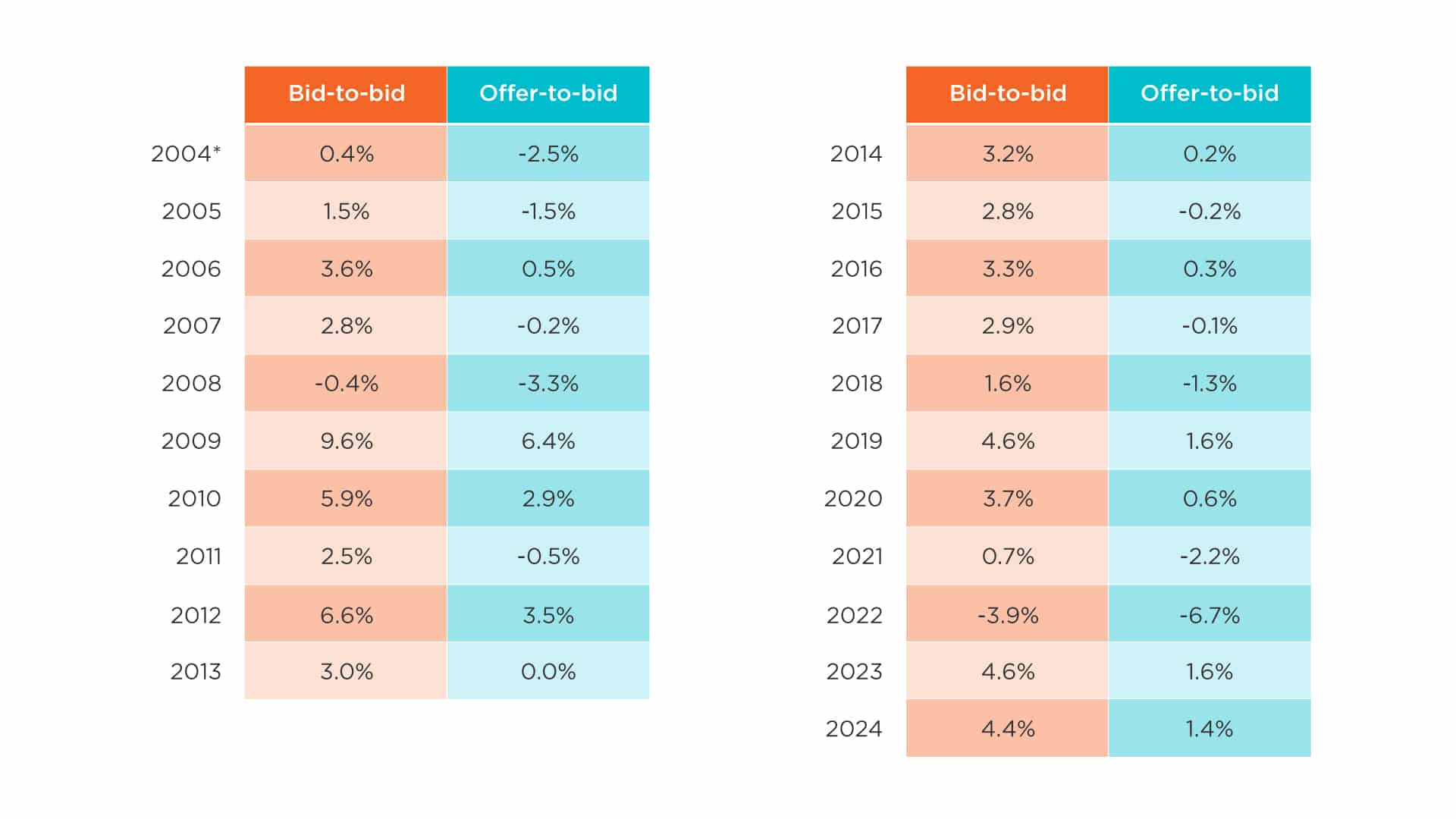

FSTIR Class A performance: calendar year bid-to-bid and offer-to-bid returns since inception (9 Sep 2004)

Source: Fullerton Fund Management. Returns are calculated on a single pricing basis in SGD with net dividends and distributions (If any) reinvested. Offer-to-bid returns include an assumed preliminary charge of 3% which may or may not be charged to investors. Past performance is not necessarily indicative of future performance. *Performance period was from 9 Sep 2004 to 31 Dec 2004.

2. Fullerton SGD Cash Fund

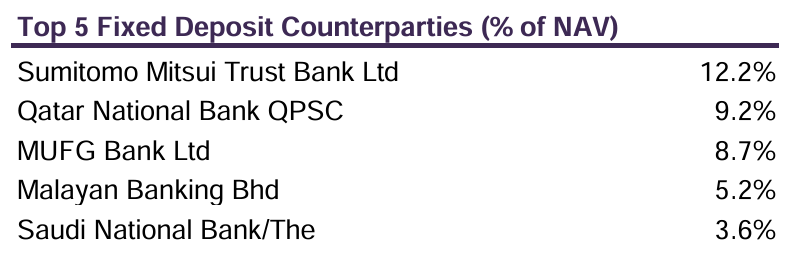

The Fullerton SGD Cash Fund is a money market fund investing solely in short-term SGD fixed deposits.

It could be an alternative investment option[1] for liquidity while earning a return that is potentially comparable to Singapore Dollar Banks Savings Deposit rates.

Source: Fullerton SGD Cash Fund Factsheet as of 31 July 2025

It offers daily liquidity with T+1 redemption[2], and since it solely invests in SGD-denominated Savings deposits, there is no foreign currency risk^.

However, as it’s an investment, capital is not guaranteed.

^Please refer to the Fund’s prospectus for the full list of risk disclosures of the Fund.

3. Fullerton SGD Savers Fund

This fund seeks to balance between liquidity and yield, targeting a higher return than SGD fixed deposit rate.

It may invest in short-term deposits, local and foreign short-term government and investment-grade corporate bonds. Foreign currency bonds are hedged to SGD*.

The fund was launched in 2023 and currently manages S$46.97 million in assets, as of 30 June 2025.

* Except for a 5% frictional currency limit to account for possible deviations from a 100% hedge

Source: Fullerton SGD Savers Fund Factsheet as of 31 July 2025

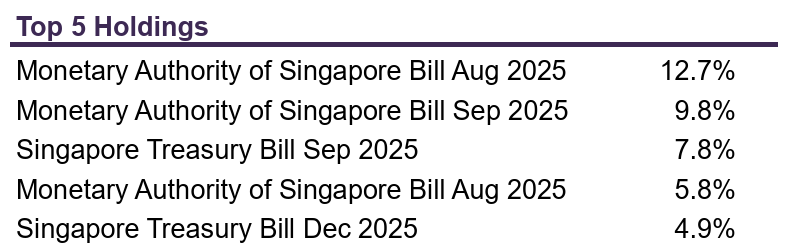

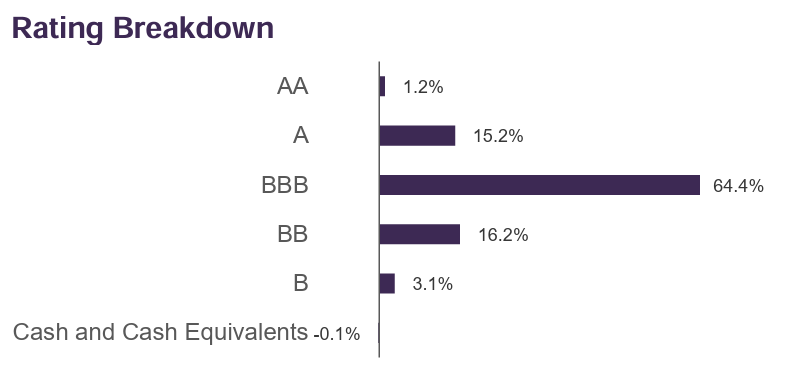

4. Fullerton SGD Income Fund

This fund aims to generate long-term capital appreciation and/or income for investors in SGD terms by investing primarily in fixed income or debt securities.

This fund is actively managed and globally diversified, with the ability to invest up to 30% in high-yield bonds[3]. The fund may invest in foreign currency bonds, which are hedged to the SGD*.

* Except for a 5% frictional currency limit to account for possible deviations from a 100% hedge

Source: Fullerton SGD Income Fund Factsheet as of 31 July 2025

The investment of this fund approach combines top-down macroeconomic analysis to assess where interest rates might be heading, with bottom-up credit research, which helps in selecting individual bonds and structuring the portfolio across the yield curve.

What to watch for

- These funds are not capital guaranteed so their net asset value (NAV) can fluctuate.

- These funds carry interest rate risk and credit risk^.

- As with all investments, consider your goals and time horizon before making a decision.

Explore these Fullerton Funds in more detail here: https://www.fullertonfund.com/investment-funds/fund-range/

^Please refer to the Fund’s prospectus for the full list of risk disclosures of the Fund.

Important information

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

[1] The Fund does not offer any performance or capital guarantee. Investors should note that investments in the Fund may expose investors to risks that are different from pure deposit products. Any investments in the Fund must not at any time be thought of as similar to a deposit in a bank.

[2] Subject to redemption gate of 25% of fund AUM on any dealing day, per Fund prospectus.

[3] Bonds with a long-term credit rating of less than BBB- by Standard & Poor’s, Baa3 by Moody’s or BBB- by Fitch (or their respective equivalents).