Could Asian Short Duration Bonds Offer Income Opportunities as Rates Fall?

Following the Fed’s rate cut in September 2025 and with expectations of more to come, interest rates are starting to move lower. In Singapore, we’ve already seen T-bill yields decline and savings account rates fall.

For investors looking for income opportunities while managing risk, short duration bond funds could offer a compelling balance.

In this edition, we take a closer look at the Fullerton Lux Funds – Asian Short Duration Bonds, and why it may appeal to investors seeking income and stability in today’s market environment.

What is the Fullerton Lux Funds – Asian Short Duration Bonds?

This fund invests in a diversified portfolio of USD-denominated Asian bonds, primarily focusing on investment-grade issuers across Asian markets including China, South Korea, India, Singapore, and Indonesia.

Its objective is to deliver long-term capital appreciation and income returns, with less sensitivity to interest rate changes compared to longer-duration bonds.

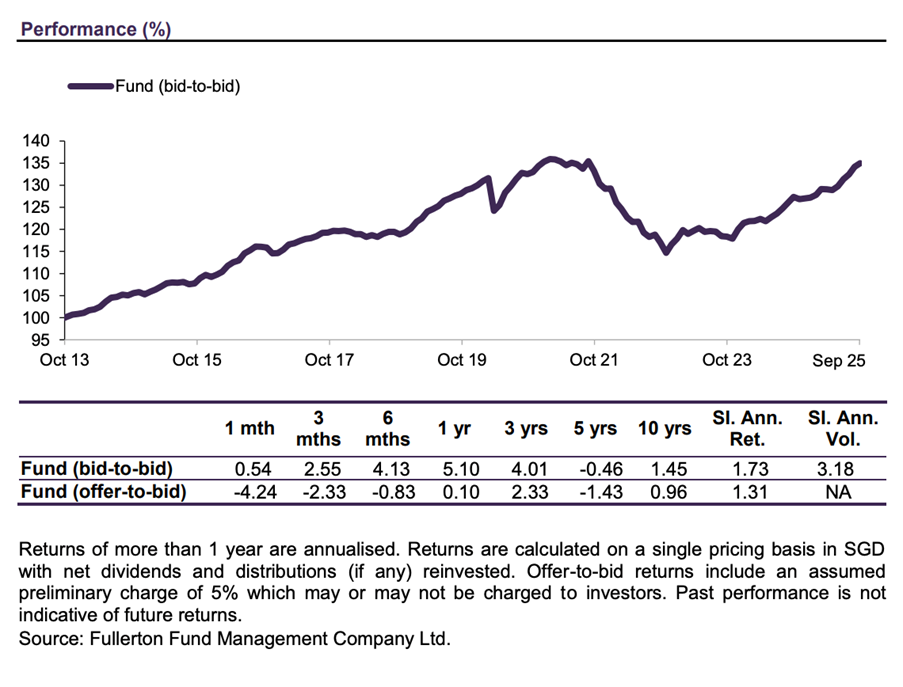

Source: Fullerton Fund Management fund. Fullerton Lux Funds – Asian Short Duration Bonds A (SGD) Hedged Dist factsheet as of 30 September 2025

Since its inception on 10 June 2014, the Fullerton Lux Funds – Asian Short Duration Bonds A (SGD) Hedged Dist has generated an average annualised return of 1.73% (bid-to-bid, annualised) as of 30 September 2025.

What you need to know about Fullerton Lux Funds – Asian Short Duration Bonds

1.Lower sensitivity to interest rate changes

Short duration bonds typically see smaller price movements when interest rates change.

This makes them typically more stable than long-duration bonds, a key advantage for investors who are looking for less price fluctuations in their bond portfolios.

The fund’s average duration stood at 2.8 years as of 31 August 2025, helping to manage volatility while maintaining exposure to attractive income opportunities in the Asian fixed income space.

2.Exposure to quality Asian issuers

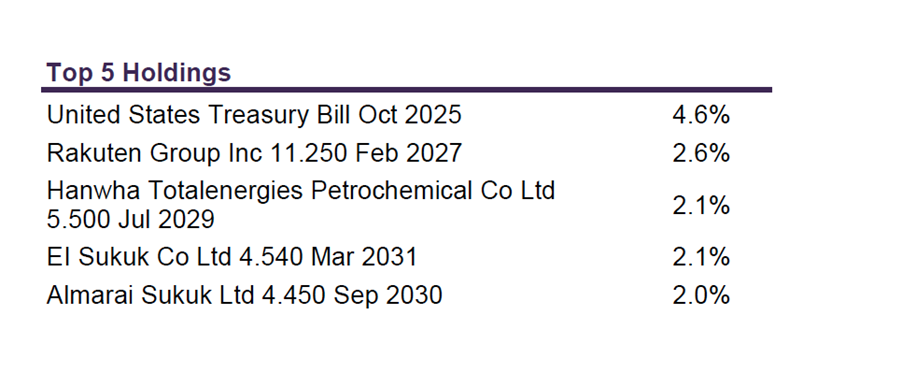

The fund focuses on investment-grade credits with strong fundamentals. These include government-linked and corporate issuers across Asia offering attractive valuations and robust credit profiles.

As of August 2025, the fund’s average credit rating is BBB, striking a balance between quality and yield potential.

Source: Fullerton Fund Management fund. Fullerton Lux Funds – Asian Short Duration Bonds A (SGD) Hedged Dist factsheet as of 30 September 2025

3. Regular income through distributions

The Fullerton Lux Funds – Asian Short Duration Bonds A (SGD) Hedged Dist offers a quarterly distribution at the fund manager’s absolute discretion which may be declared out of income and/ or capital. You may refer to Fullerton’s website for details on historical payouts.

By including both investment-grade and high-yield bonds, the fund aims to deliver income from a broader range of credit opportunities.

4. Managed by an experienced team

The fund is managed by Fullerton’s dedicated fixed income team, backed by a consistent track record in navigating Asia’s bond markets across different cycles.

Key risks to note

Like all bond investments, this fund carries certain risks*:

- Interest rate risk – Rising interest rates may lead to a decline in bond prices.

- Credit risk – Even with a focus on investment-grade issuers, repayment issues may still arise.

- Currency risk – For non-SGD hedged share classes, foreign exchange movements may affect returns.

The fund is not capital guaranteed, and its value may fluctuate with market conditions.

*Please refer to the fund prospectus for the full list of risk disclosures of the fund.

Final thoughts

In a world of falling interest rates, investors may be looking for more resilient sources of income.

Asian short duration bond funds like the Fullerton Lux Funds strategy offer a way to stay invested in quality issuers, earn regular payouts, and manage interest rate sensitivity, all while tapping into the region’s long-term growth.

If you’re seeking stability with income in a changing market, this fund may be worth a closer look.

Explore more about the Fullerton Lux Funds – Asian Short Duration Bonds here.

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.