With T-bill yields dipping again and banks cutting savings rates, many of us are asking — what’s next for our cash?

If you are comfortable with a little more risk for potentially better returns, while still keeping volatility manageable, short-term investment-grade bond funds may be the next step up.

In this post, we break down how these funds work and why they may be a viable option in today’s environment.

What is the Fullerton Short-Term Interest Rate Fund?

The Fullerton Short-Term Interest Rate Fund (FSTIR) aims to provide capital appreciation over the medium term by investing in a diversified mix of high-quality bonds that mature within five years.

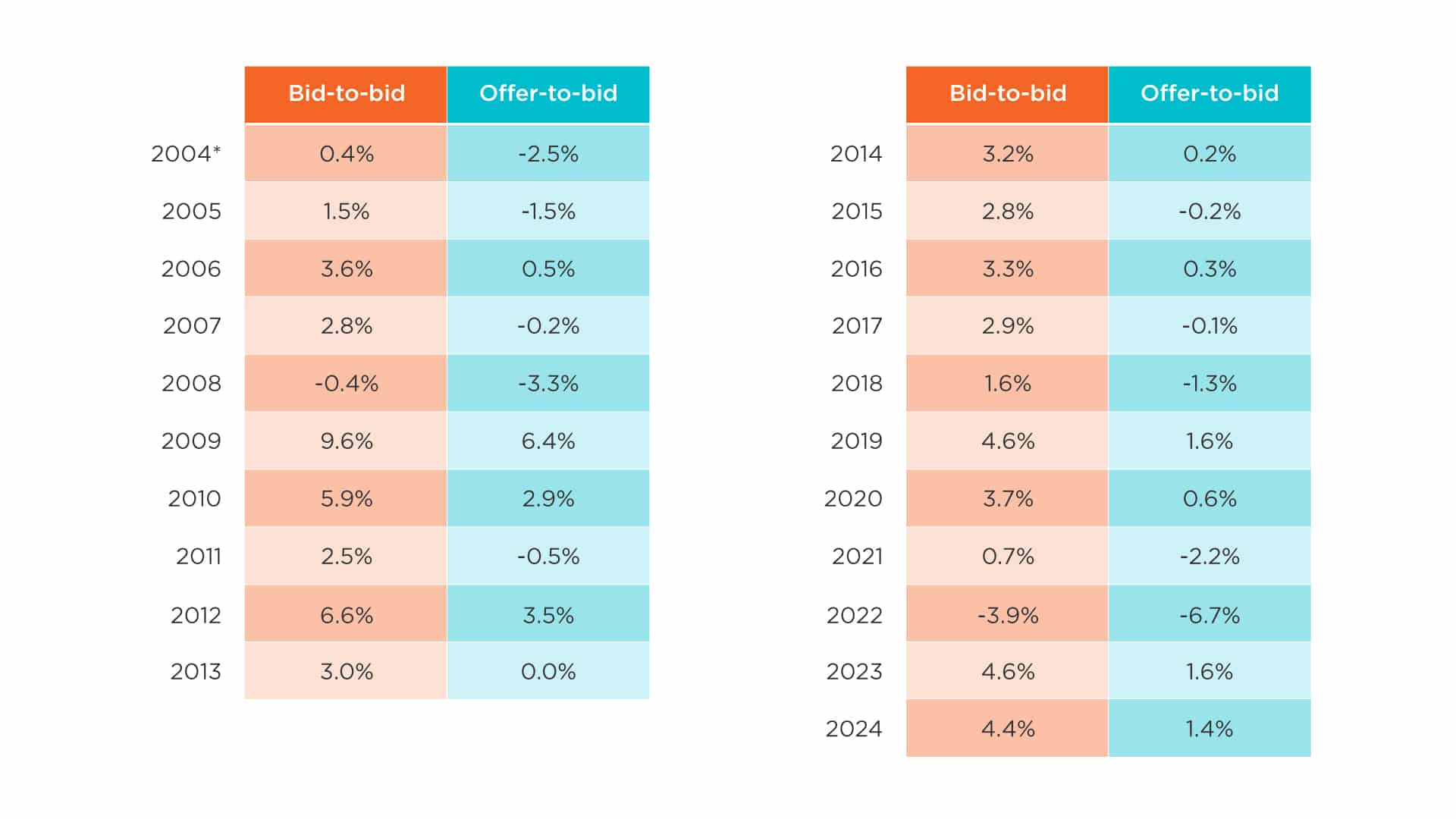

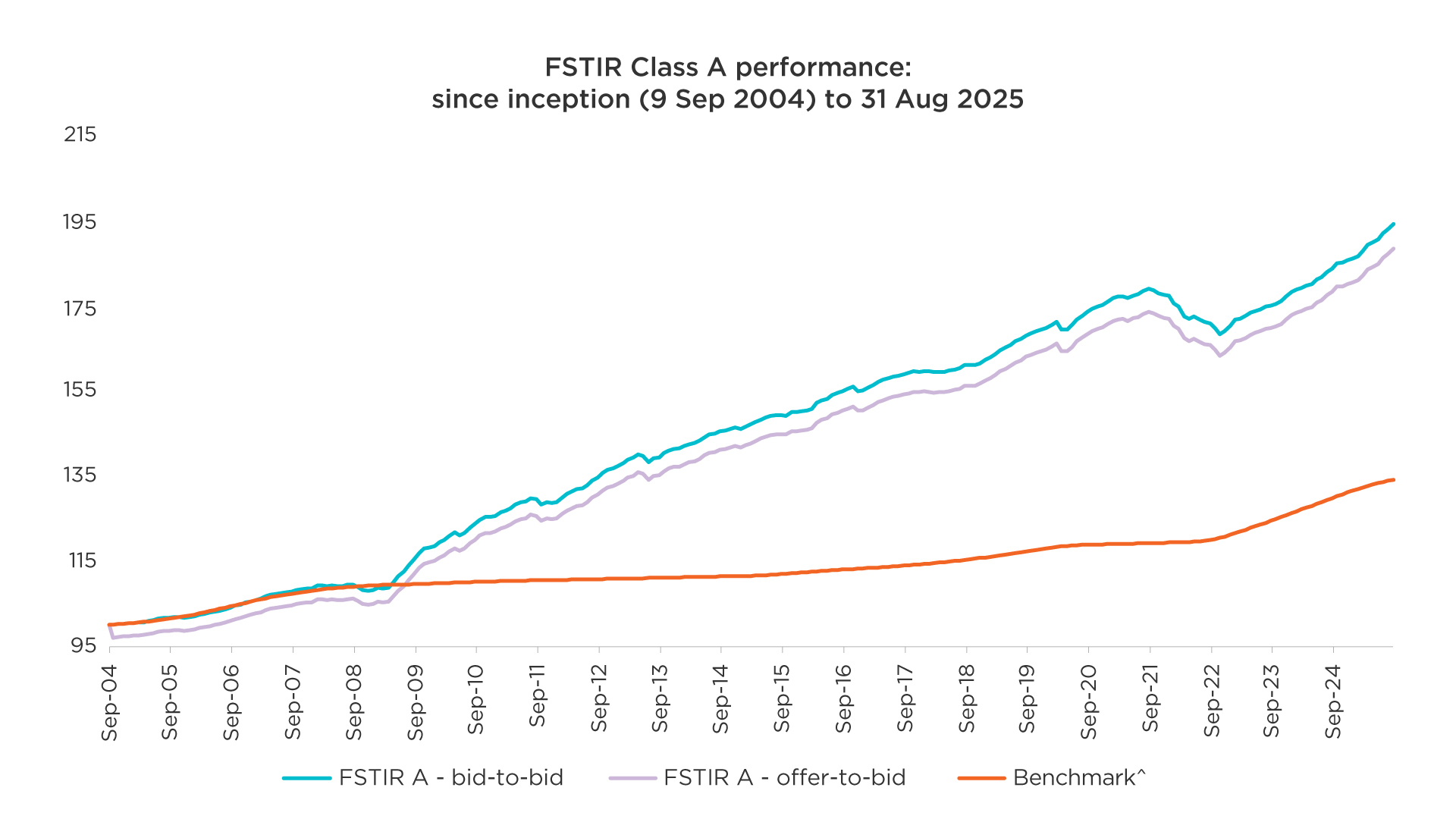

The fund has a strong 21-year track record, delivering positive net returns in 19 of the past 21 calendar years since its inception in September 2004 (class A share class).

This reflects its consistent approach to managing risk and seeking opportunities across different market cycles.

Source: Fullerton Fund Management. Returns are calculated on a single pricing basis in SGD with net dividends and distributions (If any) reinvested. Offer-to-bid returns include an assumed preliminary charge of 3% which may or may not be charged to investors. Past performance is not necessarily indicative of future performance. *Performance period was from 9 Sep 2004 to 31 Dec 2004. ^From 1 Aug 2023, the benchmark is 3M SORA + 0.60% p.a. From inception till 31 July 2023, the benchmark was 3M SIBID.

Why consider short-term bond funds?

1. Diversification with high-quality bonds

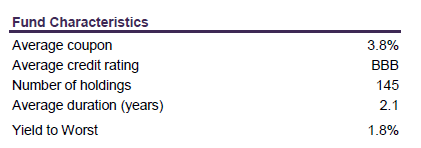

FSTIR goes beyond just T-bills — it holds a basket of investment-grade bonds from corporates and government-linked entities, including Singapore banks and property firms. This helps spread out risk across different issuers and sectors.

Source: Fullerton Fund Management, 31 August 2025

Plus, any foreign currency exposure is fully hedged to SGD1, so you’re less affected by currency swings.

And if you need access to your money, the fund offers daily liquidity2 — no need to lock up your funds.

1Except for a 5% frictional currency limit to account for possible deviations from a 100% hedge

2Subject to the Terms and Conditions of the Fund’s prospectus

2. Potentially more yield resilience if rates fall

While money market yields can respond quickly to rising rates, they also tend to fall just as quickly when rates decline.

FSTIR, on the other hand, holds short-term bonds of up to 5 years, which can lock in higher yields for longer. This means it could offer potentially more income resilience even if interest rates trend lower in the months ahead.

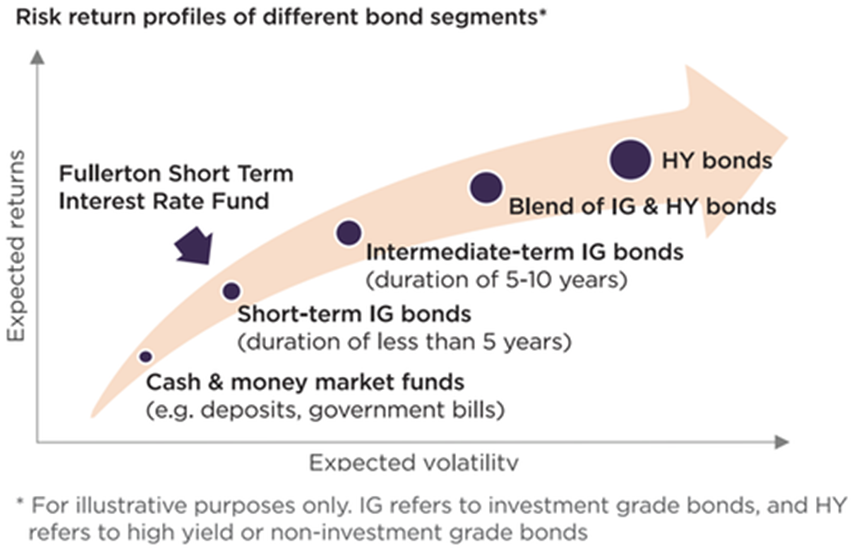

3. Lower volatility than long-term bond funds

Longer-term bonds may deliver higher gains if rates fall sharply, but they also carry more price swings if rates stay high.

FSTIR maintains an average portfolio duration of about 2 years currently, helping it stay less sensitive to interest rate changes.

This can provide a more stable experience for investors who prefer to avoid large swings in portfolio value, especially in today’s uncertain interest rate environment.

Source: Fullerton Fund Management

Key risks to be aware of

While FSTIR invests in high-quality bonds, it’s not the same as a fixed deposit or T-bill. There’s no guarantee on your principal, and the value of your investment can go up or down, especially if you exit during periods of market volatility.

Learn more about the Fullerton Short-Term Interest Rate Fund

With falling interest rates back in focus, many investors are once again faced with the challenge of balancing returns, risks, and liquidity when managing their cash or short-term savings.

Money market funds and T-bills remain solid options for relatively low-risk, highly liquid holdings, but may see yields drift lower as rates decline.

On the other end, longer-term bond funds can offer higher potential returns, but with greater price volatility if rate expectations shift.

This is where short-term bond funds like the Fullerton Short-Term Interest Rate Fund may serve as a useful middle ground.

Learn more about the Fullerton Short-Term Interest Rate Fund here.

Important information

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.